Summary

In an era when derivatives is getting popular, risk management has gradually become the core content of modern finance. In order to study how to accurately estimate the volatility of the S&P 500 index, after introducing the theoretical background of several methods, this paper uses the historical volatility method, GARCH model method and implied volatility method to estimate the real volatility respectively. At the same time, two ways of adjusting the estimation window, rolling and increasing, are also considered. The unbiased test and goodness of fit test are used to evaluate these methods. The empirical result shows that the implied volatility is the best estimator of the real volatility. The rolling estimation window is recommended when using the historical volatility. On the contrary, the estimation window is supposed to be increased when using the GARCH model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

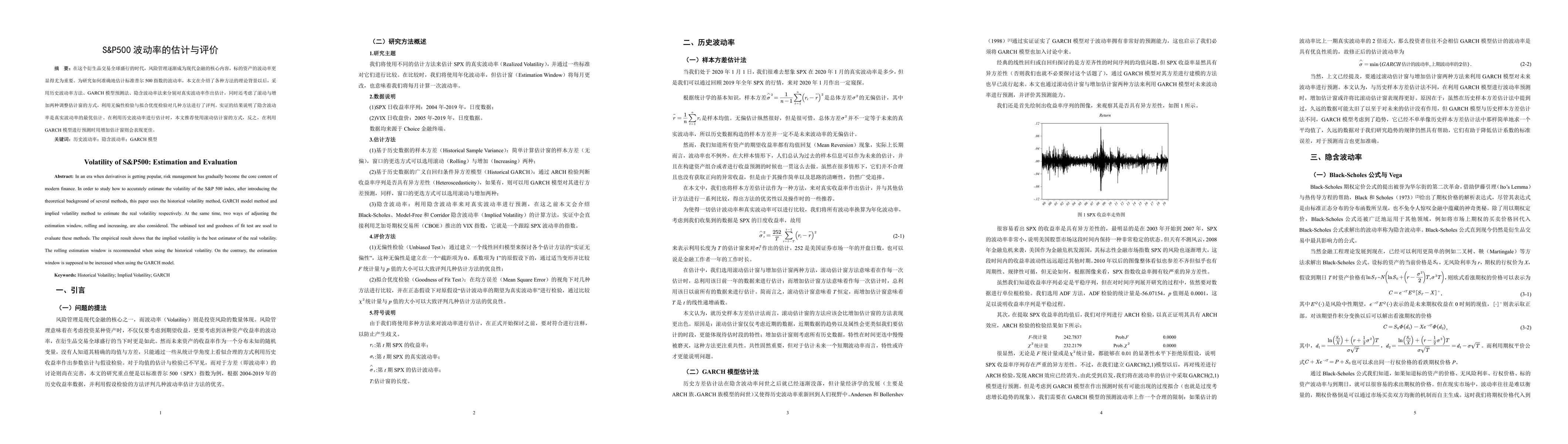

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWhy is the volatility of single stocks so much rougher than that of the S&P500?

Jean-Philippe Bouchaud, Emmanuel Bacry, Cecilia Aubrun et al.

No citations found for this paper.

Comments (0)