Authors

Summary

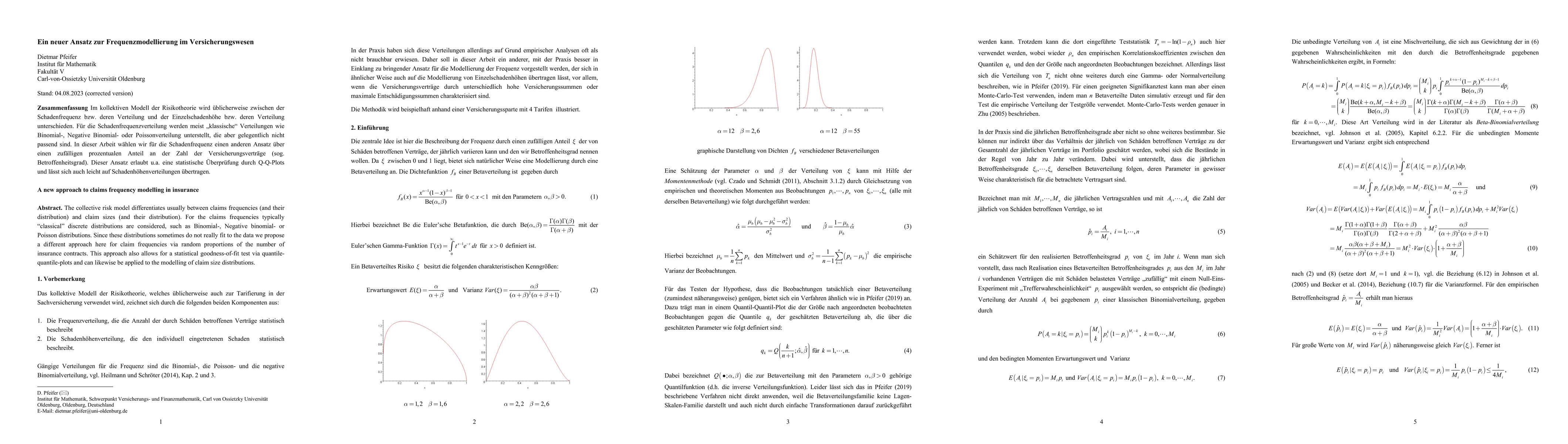

The collective risk model differentiates usually between claims frequencies (and their distribution) and claim sizes (and their distribution). For the claims frequencies typically classical discrete distributions are considered, such as Binomial-, Negative binomial- or Poisson distributions. Since these distributions sometimes do not really fit to the data we propose a different approach here for claim frequencies via random proportions of the number of insurance contracts. This approach also allows for a statistical goodness-of-fit test via quantile-quantile-plots and can likewise be applied to the modelling of claim size distributions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDatenkompetenz im Physikstudium -- ein Erfahrungsbericht

Michael Krieger, Heiko B. Weber, Christopher van Eldik

${\rm S{\scriptsize IM}BIG}$: A Forward Modeling Approach To Analyzing Galaxy Clustering

Pablo Lemos, Chirag Modi, Elena Massara et al.

No citations found for this paper.

Comments (0)