Summary

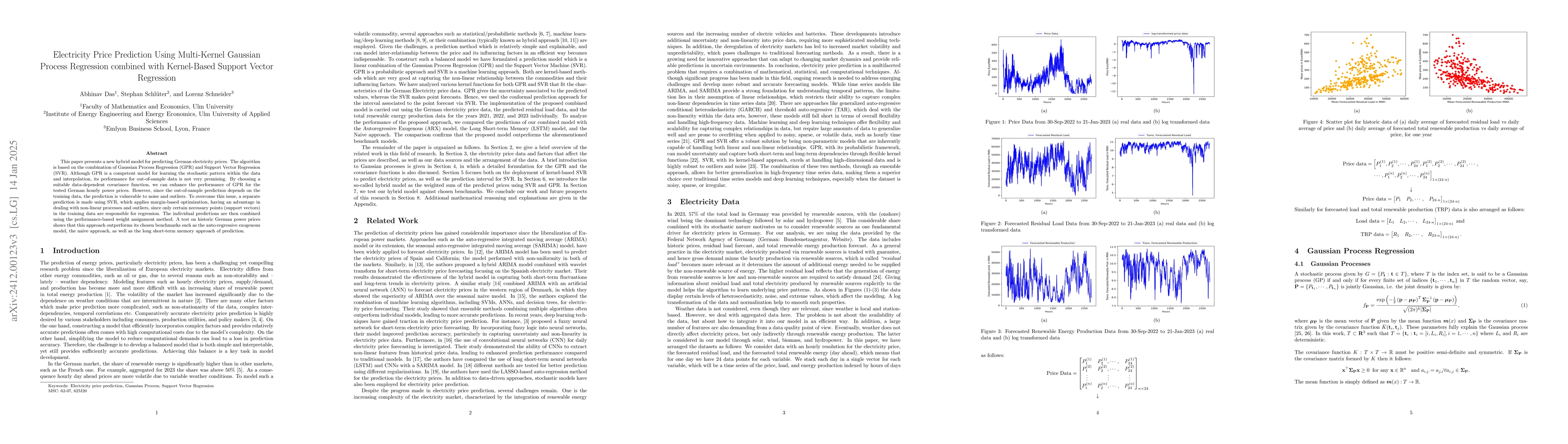

This paper presents a new hybrid model for predicting German electricity prices. The algorithm is based on combining Gaussian Process Regression (GPR) and Support Vector Regression (SVR). While GPR is a competent model for learning the stochastic pattern within the data and interpolation, its performance for out-of-sample data is not very promising. By choosing a suitable data-dependent covariance function, we can enhance the performance of GPR for the tested German hourly power prices. However, since the out-of-sample prediction depends on the training data, the prediction is vulnerable to noise and outliers. To overcome this issue, a separate prediction is made using SVR, which applies margin-based optimization, having an advantage in dealing with non-linear processes and outliers, since only certain necessary points (support vectors) in the training data are responsible for regression. Both individual predictions are later combined using the performance-based weight assignment method. A test on historic German power prices shows that this approach outperforms its chosen benchmarks such as the autoregressive exogenous model, the naive approach, as well as the long short-term memory approach of prediction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConvergence of Gaussian process regression: Optimality, robustness, and relationship with kernel ridge regression

Wenjia Wang, Bing-Yi Jing

Semisupervised Anomaly Detection using Support Vector Regression with Quantum Kernel

Pascal Debus, Kilian Tscharke, Sebastian Issel

No citations found for this paper.

Comments (0)