Authors

Summary

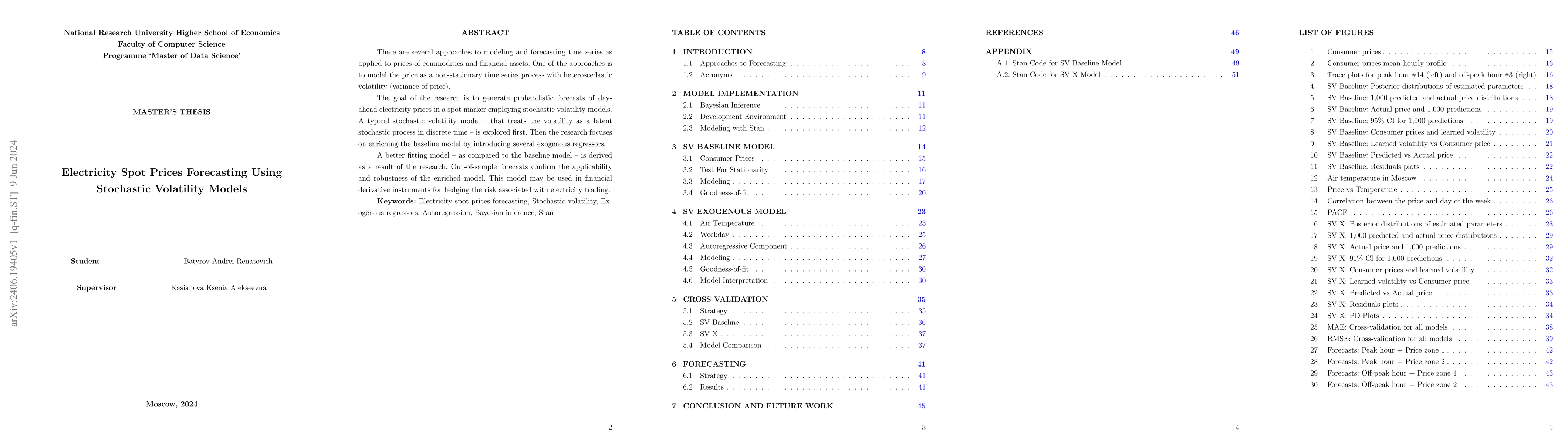

There are several approaches to modeling and forecasting time series as applied to prices of commodities and financial assets. One of the approaches is to model the price as a non-stationary time series process with heteroscedastic volatility (variance of price). The goal of the research is to generate probabilistic forecasts of day-ahead electricity prices in a spot marker employing stochastic volatility models. A typical stochastic volatility model - that treats the volatility as a latent stochastic process in discrete time - is explored first. Then the research focuses on enriching the baseline model by introducing several exogenous regressors. A better fitting model - as compared to the baseline model - is derived as a result of the research. Out-of-sample forecasts confirm the applicability and robustness of the enriched model. This model may be used in financial derivative instruments for hedging the risk associated with electricity trading. Keywords: Electricity spot prices forecasting, Stochastic volatility, Exogenous regressors, Autoregression, Bayesian inference, Stan

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersAdaptive probabilistic forecasting of French electricity spot prices

Grégoire Dutot, Margaux Zaffran, Olivier Féron et al.

No citations found for this paper.

Comments (0)