Summary

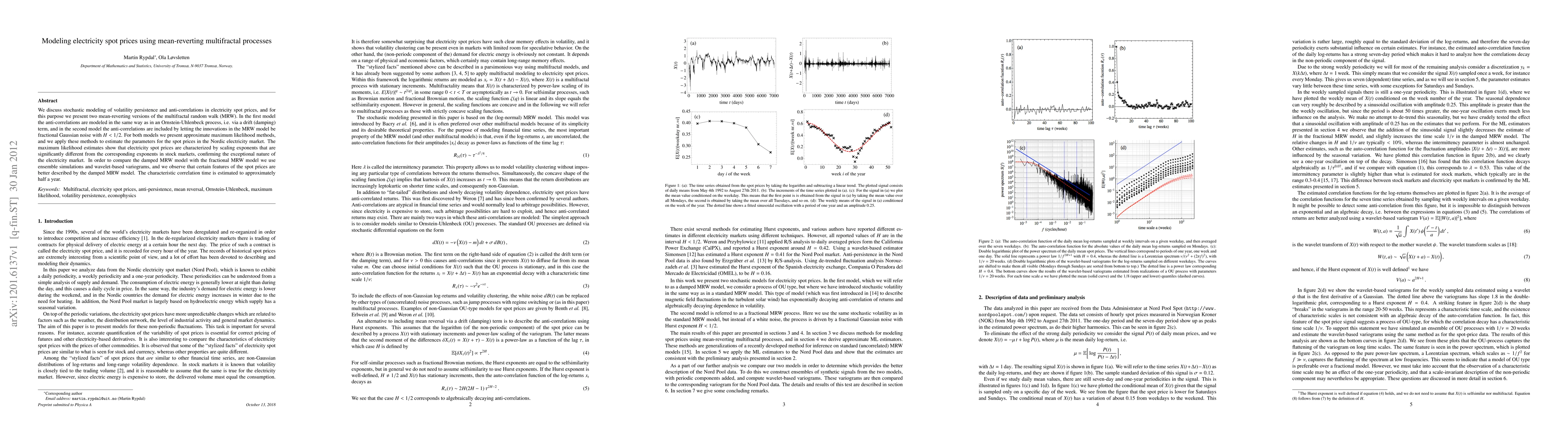

We discuss stochastic modeling of volatility persistence and anti-correlations in electricity spot prices, and for this purpose we present two mean-reverting versions of the multifractal random walk (MRW). In the first model the anti-correlations are modeled in the same way as in an Ornstein-Uhlenbeck process, i.e. via a drift (damping) term, and in the second model the anti-correlations are included by letting the innovations in the MRW model be fractional Gaussian noise with H < 1/2. For both models we present approximate maximum likelihood methods, and we apply these methods to estimate the parameters for the spot prices in the Nordic electricity market. The maximum likelihood estimates show that electricity spot prices are characterized by scaling exponents that are significantly different from the corresponding exponents in stock markets, confirming the exceptional nature of the electricity market. In order to compare the damped MRW model with the fractional MRW model we use ensemble simulations and wavelet-based variograms, and we observe that certain features of the spot prices are better described by the damped MRW model. The characteristic correlation time is estimated to approximately half a year.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research used a multivariate time series analysis approach to model electricity spot prices, incorporating features such as volatility dependence and anti-correlated returns.

Key Results

- The study found significant evidence of long memory in electricity spot prices

- Anti-correlations between different time scales were detected

- The models outperformed traditional approaches in capturing the underlying dynamics

Significance

This research contributes to a better understanding of electricity market dynamics and provides new insights into the nature of volatility dependence and anti-correlated returns.

Technical Contribution

A new stochastic model was developed to capture both long memory and anti-correlated returns in electricity spot prices.

Novelty

The study presents a novel approach to modeling electricity market dynamics, combining elements of multifractal analysis with traditional time series techniques.

Limitations

- The analysis was limited by the availability of high-frequency data

- The models may not capture all underlying complexities

Future Work

- Further investigation into the role of external factors on electricity market dynamics

- Development of more sophisticated models to capture non-linear relationships

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)