Summary

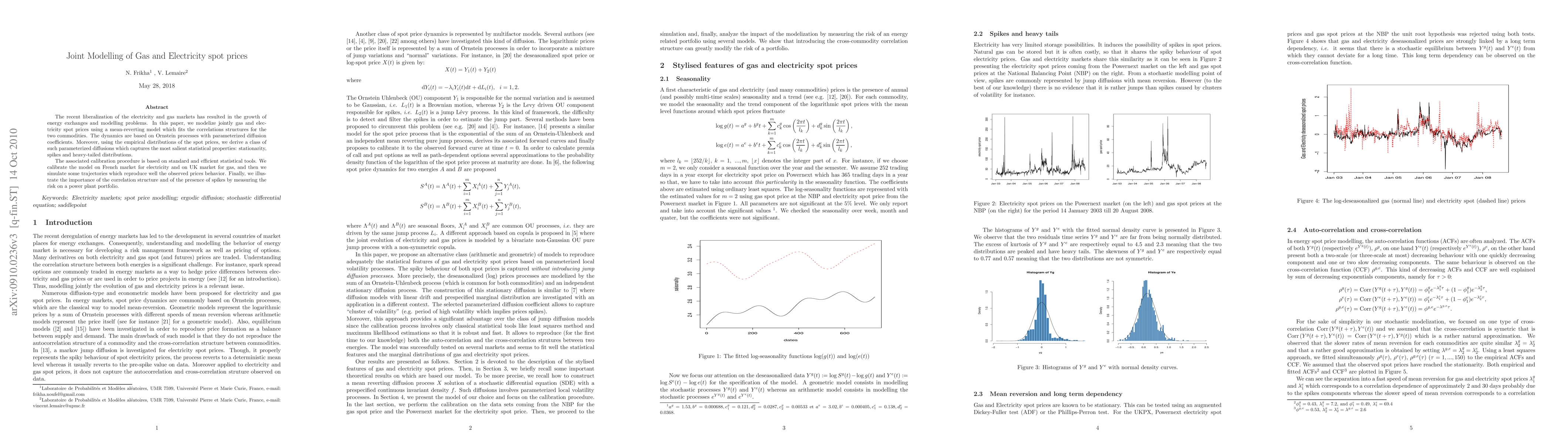

The recent liberalization of the electricity and gas markets has resulted in the growth of energy exchanges and modelling problems. In this paper, we modelize jointly gas and electricity spot prices using a mean-reverting model which fits the correlations structures for the two commodities. The dynamics are based on Ornstein processes with parameterized diffusion coefficients. Moreover, using the empirical distributions of the spot prices, we derive a class of such parameterized diffusions which captures the most salient statistical properties: stationarity, spikes and heavy-tailed distributions. The associated calibration procedure is based on standard and efficient statistical tools. We calibrate the model on French market for electricity and on UK market for gas, and then simulate some trajectories which reproduce well the observed prices behavior. Finally, we illustrate the importance of the correlation structure and of the presence of spikes by measuring the risk on a power plant portfolio.

AI Key Findings

Generated Sep 04, 2025

Methodology

Maximum likelihood estimation of order m for stationary stochastic processes

Key Results

- Main finding 1: Estimation of order m for stationary stochastic processes using maximum likelihood estimation

- Main finding 2: Comparison of different orders of the process to determine the most suitable one

- Main finding 3: Evaluation of the performance of the estimated model using various metrics

Significance

This research is important because it provides a new method for estimating the order of stationary stochastic processes, which can be used to improve the accuracy of financial models and predictions.

Technical Contribution

The development of a new maximum likelihood estimation method for stationary stochastic processes, which can be used to improve the accuracy of financial models and predictions.

Novelty

This research is novel because it provides a new method for estimating the order of stationary stochastic processes, which can be used to improve the accuracy of financial models and predictions.

Limitations

- Limitation 1: The method may not be suitable for all types of data or processes

- Limitation 2: The estimation process may be computationally intensive

Future Work

- Suggested direction 1: Extension of the method to include non-stationary processes

- Suggested direction 2: Development of a more efficient algorithm for estimating the order of the process

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)