Summary

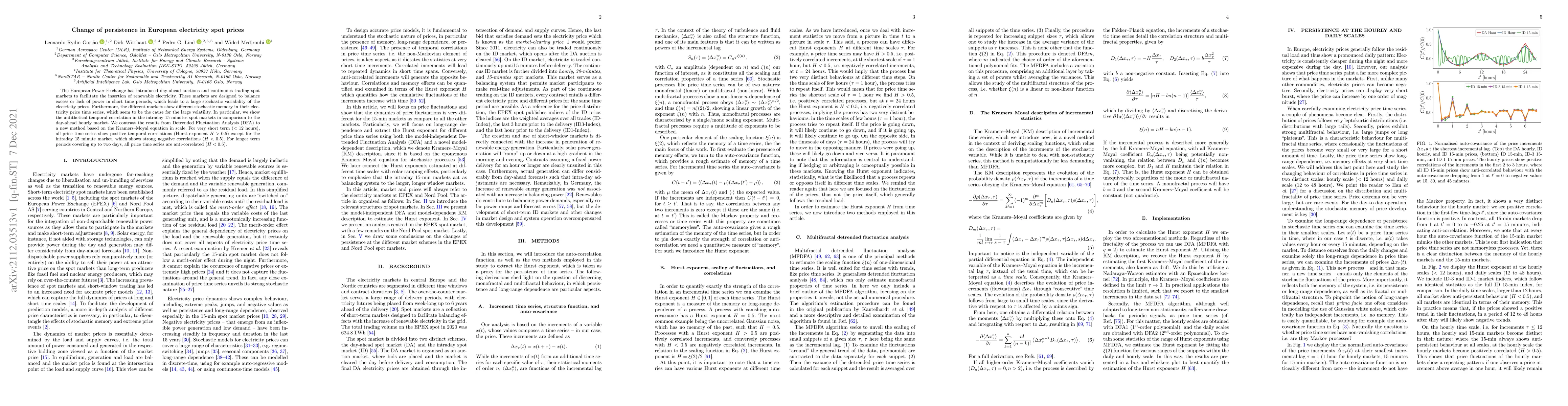

The European Power Exchange has introduced day-ahead auctions and continuous trading spot markets to facilitate the insertion of renewable electricity. These markets are designed to balance excess or lack of power in short time periods, which leads to a large stochastic variability of the electricity prices. Furthermore, the different markets show different stochastic memory in their electricity price time series, which seem to be the cause for the large volatility. In particular, we show the antithetical temporal correlation in the intraday 15 minutes spot markets in comparison to the day-ahead hourly market. We contrast the results from Detrended Fluctuation Analysis (DFA) to a new method based on the Kramers--Moyal equation in scale. For very short term ($<12$ hours), all price time series show positive temporal correlations (Hurst exponent $H>0.5$) except for the intraday 15 minute market, which shows strong negative correlations ($H<0.5$). For longer term periods covering up to two days, all price time series are anti-correlated ($H<0.5$).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)