Summary

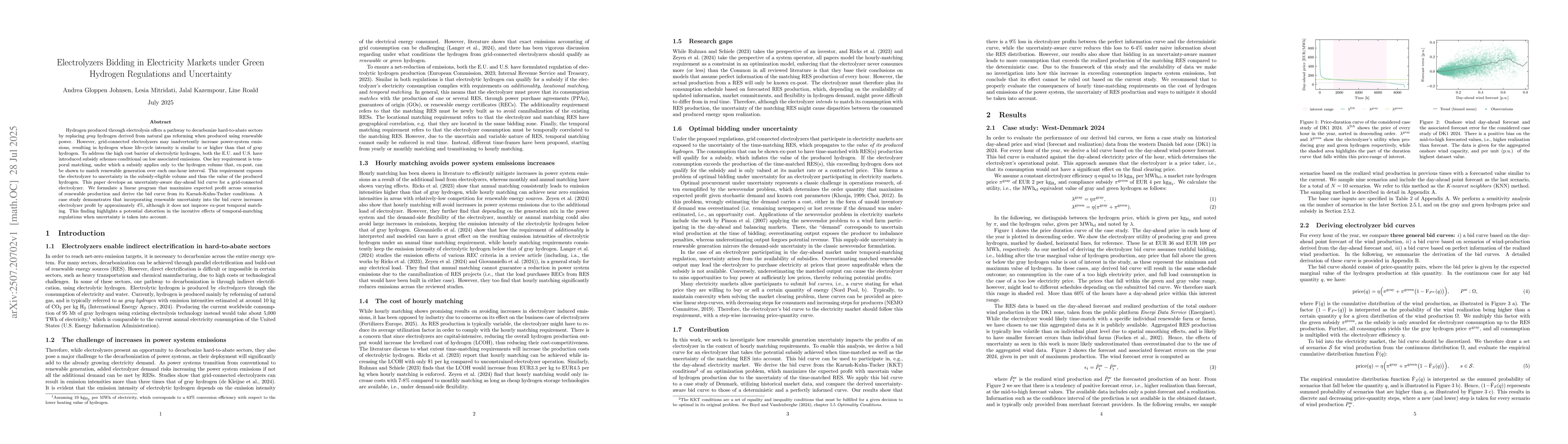

Hydrogen produced through electrolysis offers a pathway to decarbonize hard-to-abate sectors by replacing gray hydrogen derived from natural gas reforming when produced using renewable power. However, grid-connected electrolyzers may inadvertently increase power-system emissions, resulting in hydrogen whose life-cycle intensity is similar to or higher than that of gray hydrogen. To address the high cost barrier of electrolytic hydrogen, both the E.U. and U.S. have introduced subsidy schemes conditional on low associated emissions. One key requirement is temporal matching, under which a subsidy applies only to the hydrogen volume that, ex-post, can be shown to match renewable generation over each one-hour interval. This requirement exposes the electrolyzer to uncertainty in the subsidy-eligible volume and thus the value of the produced hydrogen. This paper develops an uncertainty-aware day-ahead bid curve for a grid-connected electrolyzer. We formulate a linear program that maximizes expected profit across scenarios of renewable production and derive the bid curve from its Karush-Kuhn-Tucker conditions. A case study demonstrates that incorporating renewable uncertainty into the bid curve increases electrolyzer profit by approximately 4%, although it does not improve ex-post temporal matching. This finding highlights a potential distortion in the incentive effects of temporal-matching regulations when uncertainty is taken into account.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper develops an uncertainty-aware day-ahead bid curve for a grid-connected electrolyzer using a linear program to maximize expected profit across scenarios of renewable production. The bid curve is derived from the Karush-Kuhn-Tucker conditions of this linear program.

Key Results

- Incorporating renewable uncertainty into the bid curve increases electrolyzer profit by approximately 4%.

- The scenario-based bid curve does not improve ex-post temporal matching.

- The findings suggest a potential distortion in the incentive effects of temporal-matching regulations when uncertainty is considered.

Significance

This research is important for optimizing the integration of electrolyzers into electricity markets under green hydrogen regulations, which could enhance the economic viability of green hydrogen production and reduce emissions in hard-to-abate sectors.

Technical Contribution

The paper presents a linear programming formulation for an electrolyzer's optimal bid curve that accounts for uncertainty in renewable energy production, leading to improved profitability compared to point forecast-based curves.

Novelty

This work distinguishes itself by explicitly modeling the uncertainty in renewable energy production and its effect on the value of hydrogen for the electrolyzer, providing a novel approach to bidding strategy in electricity markets.

Limitations

- The analysis does not quantify the broader impact of increased electrolyzer consumption on power system emissions.

- The study assumes perfect information for historical price signals and does not explore the impact of congestion in transmission systems.

Future Work

- Extending the analysis to historical aggregate supply and demand curves for a more comprehensive understanding of the electrolyzer's impact on market prices.

- Investigating the effectiveness of temporal regulation in the presence of uncertainty, using the derived bid curves in long-term studies.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMitigation-Aware Bidding Strategies in Electricity Markets

James Anderson, Yiqian Wu, Jip Kim

Preventing an Extractive Green Hydrogen Industry: Risks and Benefits of Grid Expansion and Green Hydrogen in and for Kenya

Daniel M. Kammen, Xi Xi, Boniface Kinyanjui

Optimizing Bidding Curves for Renewable Energy in Two-Settlement Electricity Markets

Audun Botterud, Dongwei Zhao, Stefanos Delikaraogloub et al.

No citations found for this paper.

Comments (0)