Summary

Emerging market hard-currency bonds are an asset class of growing importance, and contain exposure to an EM sovereign and the underlying industry. The authors investigate how to model this as a modification of the well-known first-to-default (FtD) basket, using the structural model, and find the approach feasible.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

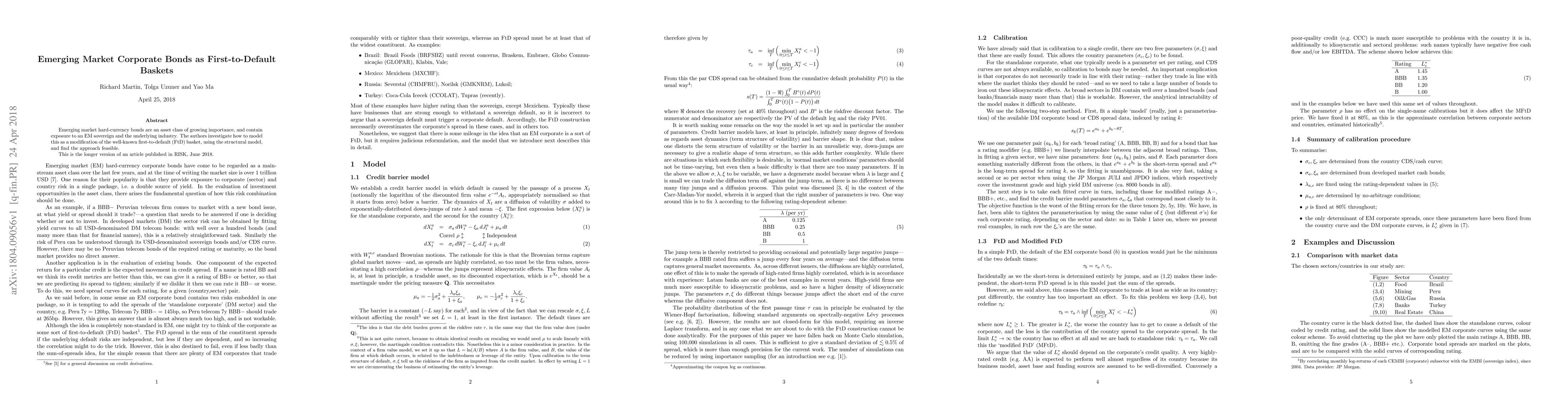

PDF Preview

Key Terms

bonds

(0.291)

exposure

(0.290)

asset

(0.282)

exposure

(0.280)

industry

(0.265)

industry

(0.263)

feasible

(0.261)

market

(0.260)

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Current Paper

Citations

References

Click to view

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)