Authors

Summary

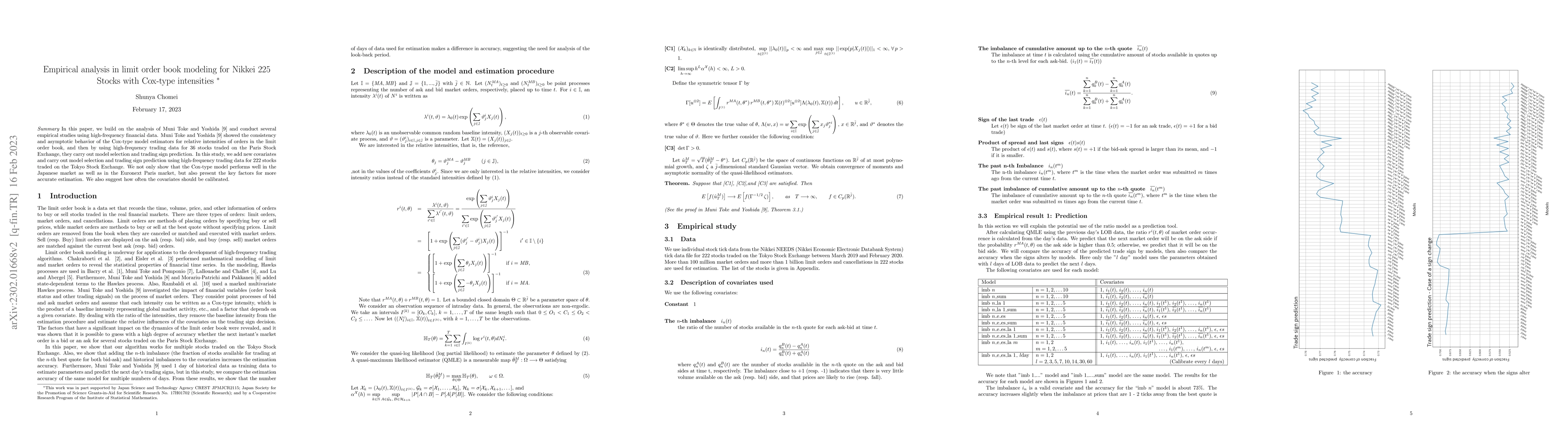

In this paper, we build on the analysis of Muni Toke and Yoshida (2020) and conduct several empirical studies using high-frequency financial data. Muni Toke and Yoshida (2020) showed the consistency and asymptotic behavior of the Cox-type model estimators for relative intensities of orders in the limit order book, and then by using high-frequency trading data for 36 stocks traded on the Paris Stock Exchange, they carry out model selection and trading sign prediction. In this study, we add new covariates and carry out model selection and trading sign prediction using high-frequency trading data for 222 stocks traded on the Tokyo Stock Exchange. We not only show that the Cox-type model performs well in the Japanese market as well as in the Euronext Paris market, but also present the key factors for more accurate estimation. We also suggest how often the covariates should be calibrated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Limit Order Book Forecasting

Antonio Briola, Silvia Bartolucci, Tomaso Aste

No citations found for this paper.

Comments (0)