Summary

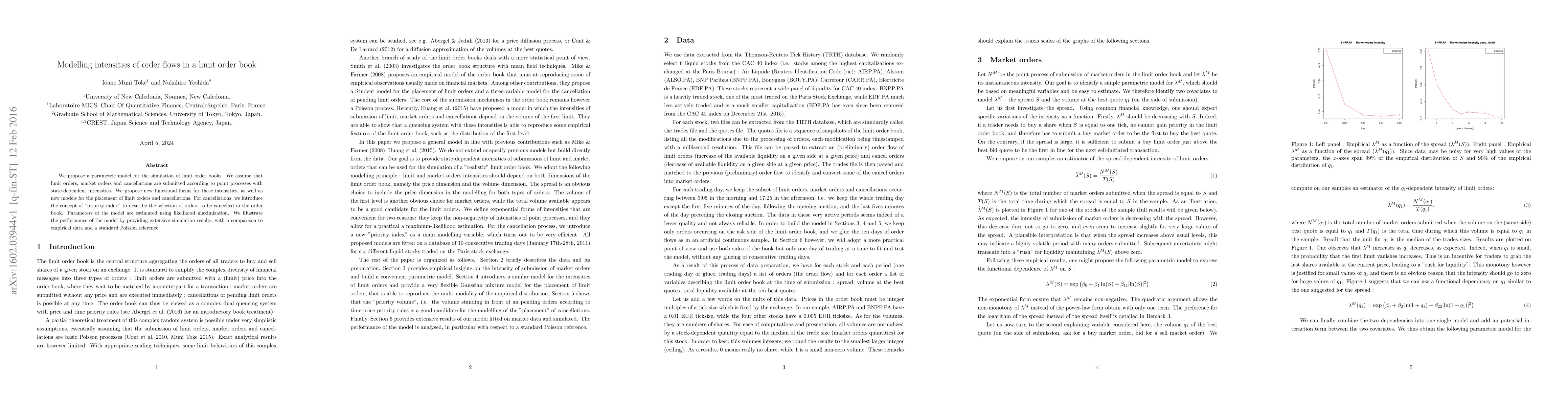

We propose a parametric model for the simulation of limit order books. We assume that limit orders, market orders and cancellations are submitted according to point processes with state-dependent intensities. We propose new functional forms for these intensities, as well as new models for the placement of limit orders and cancellations. For cancellations, we introduce the concept of "priority index" to describe the selection of orders to be cancelled in the order book. Parameters of the model are estimated using likelihood maximization. We illustrate the performance of the model by providing extensive simulation results, with a comparison to empirical data and a standard Poisson reference.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFill Probabilities in a Limit Order Book with State-Dependent Stochastic Order Flows

Felix Lokin, Fenghui Yu

| Title | Authors | Year | Actions |

|---|

Comments (0)