Summary

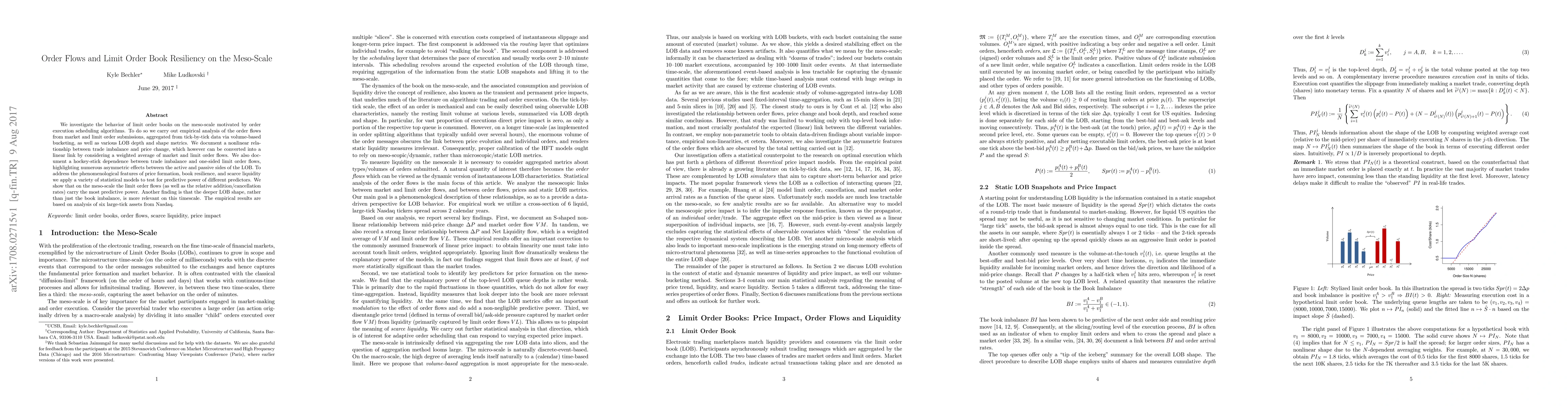

We investigate the behavior of limit order books on the meso-scale motivated by order execution scheduling algorithms. To do so we carry out empirical analysis of the order flows from market and limit order submissions, aggregated from tick-by-tick data via volume-based bucketing, as well as various LOB depth and shape metrics. We document a nonlinear relationship between trade imbalance and price change, which however can be converted into a linear link by considering a weighted average of market and limit order flows. We also document a hockey-stick dependence between trade imbalance and one-sided limit order flows, highlighting numerous asymmetric effects between the active and passive sides of the LOB. To address the phenomenological features of price formation, book resilience, and scarce liquidity we apply a variety of statistical models to test for predictive power of different predictors. We show that on the meso-scale the limit order flows (as well as the relative addition/cancellation rates) carry the most predictive power. Another finding is that the deeper LOB shape, rather than just the book imbalance, is more relevant on this timescale. The empirical results are based on analysis of six large-tick assets from Nasdaq.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFill Probabilities in a Limit Order Book with State-Dependent Stochastic Order Flows

Felix Lokin, Fenghui Yu

Deep Limit Order Book Forecasting

Antonio Briola, Silvia Bartolucci, Tomaso Aste

| Title | Authors | Year | Actions |

|---|

Comments (0)