Summary

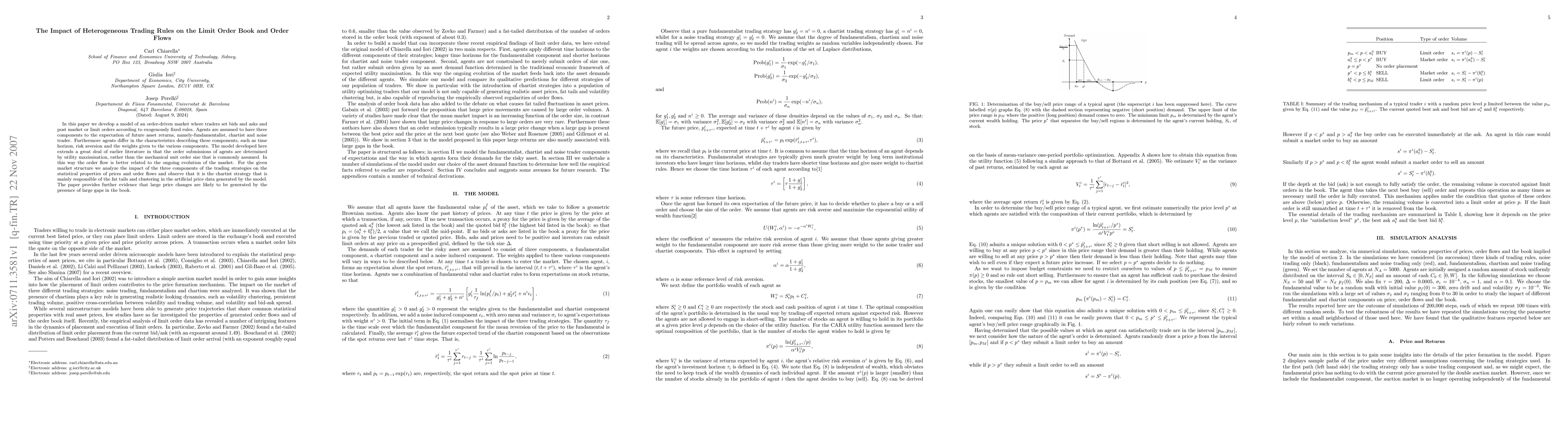

In this paper we develop a model of an order-driven market where traders set bids and asks and post market or limit orders according to exogenously fixed rules. Agents are assumed to have three components to the expectation of future asset returns, namely-fundamentalist, chartist and noise trader. Furthermore agents differ in the characteristics describing these components, such as time horizon, risk aversion and the weights given to the various components. The model developed here extends a great deal of earlier literature in that the order submissions of agents are determined by utility maximisation, rather than the mechanical unit order size that is commonly assumed. In this way the order flow is better related to the ongoing evolution of the market. For the given market structure we analyze the impact of the three components of the trading strategies on the statistical properties of prices and order flows and observe that it is the chartist strategy that is mainly responsible of the fat tails and clustering in the artificial price data generated by the model. The paper provides further evidence that large price changes are likely to be generated by the presence of large gaps in the book.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Limit Order Book Forecasting

Antonio Briola, Silvia Bartolucci, Tomaso Aste

| Title | Authors | Year | Actions |

|---|

Comments (0)