Summary

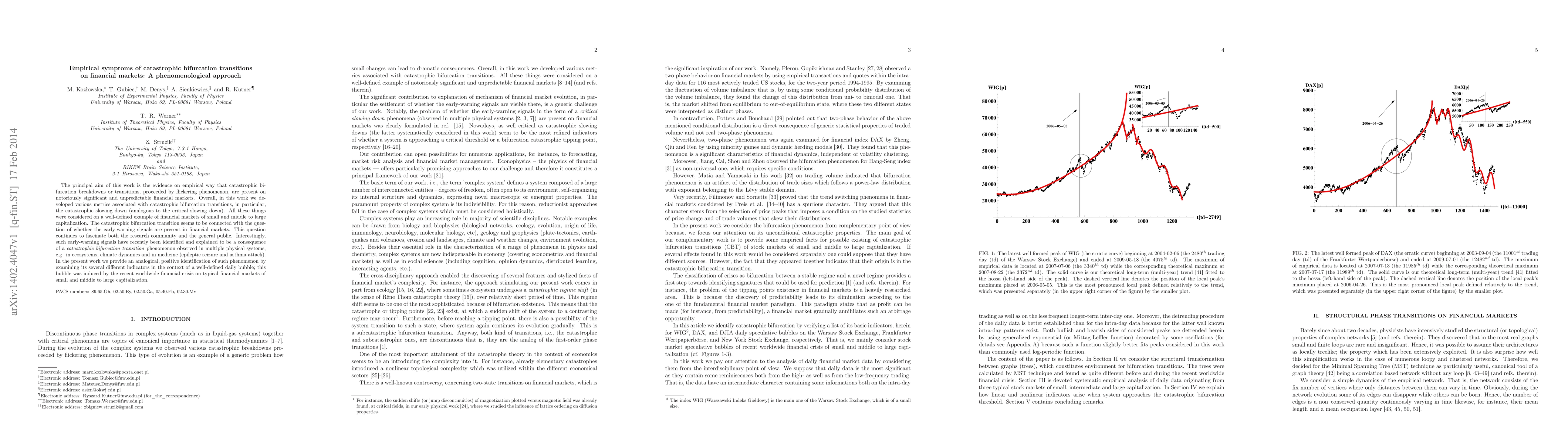

The principal aim of this work is the evidence on empirical way that catastrophic bifurcation breakdowns or transitions, proceeded by flickering phenomenon, are present on notoriously significant and unpredictable financial markets. Overall, in this work we developed various metrics associated with catastrophic bifurcation transitions, in particular, the catastrophic slowing down (analogous to the critical slowing down). All these things were considered on a well-defined example of financial markets of small and middle to large capitalization. The catastrophic bifurcation transition seems to be connected with the question of whether the early-warning signals are present in financial markets. This question continues to fascinate both the research community and the general public. Interestingly, such early-warning signals have recently been identified and explained to be a consequence of a catastrophic bifurcation transition phenomenon observed in multiple physical systems, e.g. in ecosystems, climate dynamics and in medicine (epileptic seizure and asthma attack). In the present work we provide an analogical, positive identification of such phenomenon by examining its several different indicators in the context of a well-defined daily bubble; this bubble was induced by the recent worldwide financial crisis on typical financial markets of small and middle to large capitalization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)