Summary

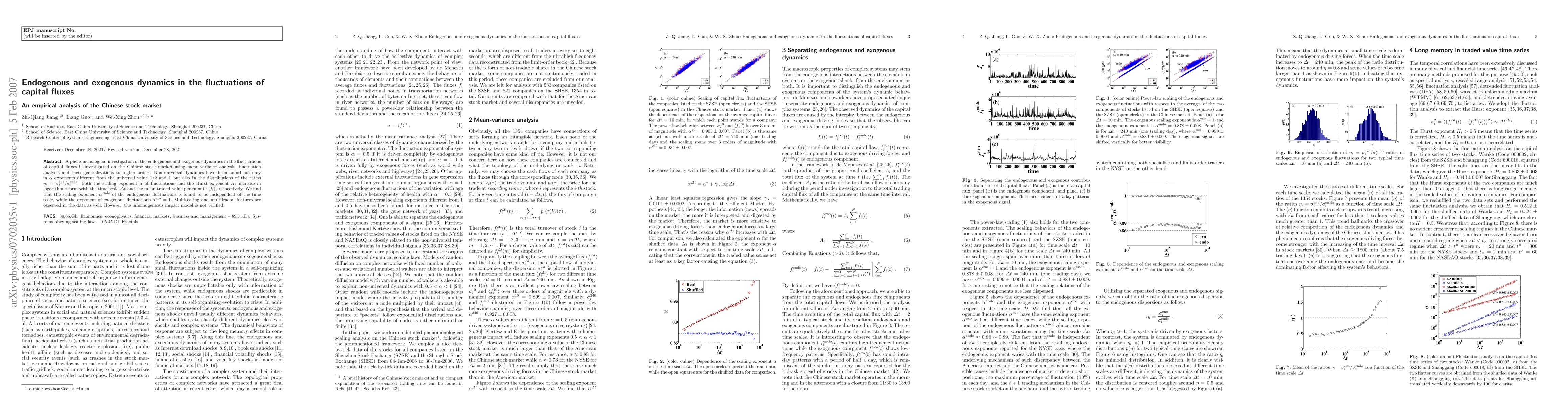

A phenomenological investigation of the endogenous and exogenous dynamics in

the fluctuations of capital fluxes is investigated on the Chinese stock market

using mean-variance analysis, fluctuation analysis and their generalizations to

higher orders. Non-universal dynamics have been found not only in $\alpha$

exponents different from the universal value 1/2 and 1 but also in the

distributions of the ratios $\eta_i = \sigma_i^{\rm{exo}} /

\sigma_i^{\rm{endo}}$. Both the scaling exponent $\alpha$ of fluctuations and

the Hurst exponent $H_i$ increase in logarithmic form with the time scale

$\Delta t$ and the mean traded value per minute $

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Market Making in the Chinese Stock Market: A Stochastic Control and Scenario Analysis

Shuaiqiang Liu, Shiqi Gong, Danny D. Sun

The Predictability of Stock Price: Empirical Study onTick Data in Chinese Stock Market

Tian Lan, Xingyu Xu, Sihai Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)