Summary

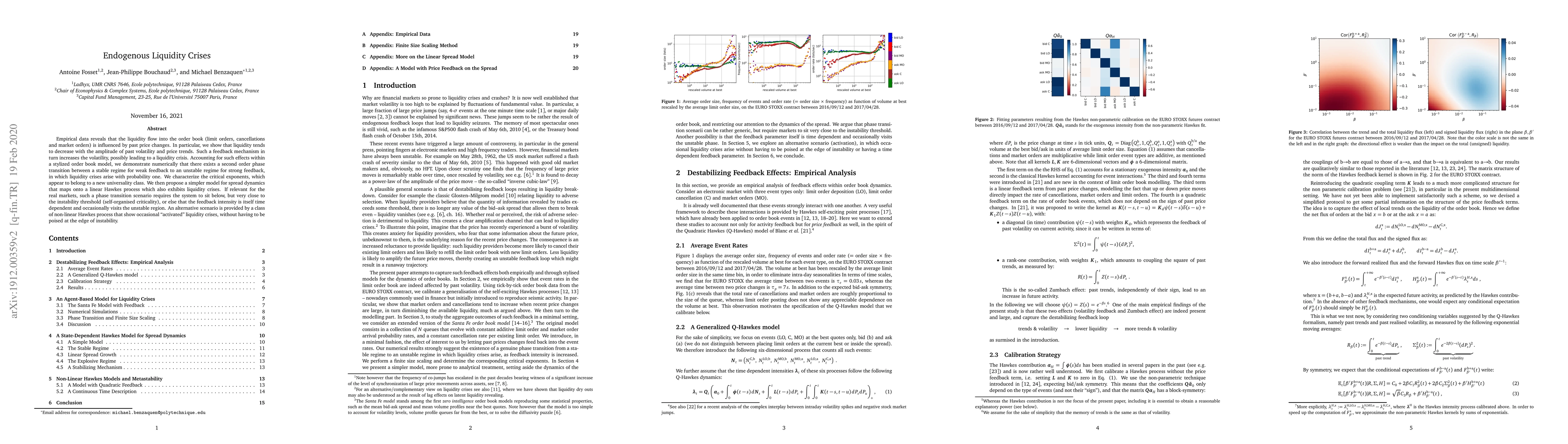

Empirical data reveals that the liquidity flow into the order book (depositions, cancellations andmarket orders) is influenced by past price changes. In particular, we show that liquidity tends todecrease with the amplitude of past volatility and price trends. Such a feedback mechanism inturn increases the volatility, possibly leading to a liquidity crisis. Accounting for such effects withina stylized order book model, we demonstrate numerically that there exists a second order phasetransition between a stable regime for weak feedback to an unstable regime for strong feedback,in which liquidity crises arise with probability one. We characterize the critical exponents, whichappear to belong to a new universality class. We then propose a simpler model for spread dynamicsthat maps onto a linear Hawkes process which also exhibits liquidity crises. If relevant for thereal markets, such a phase transition scenario requires the system to sit below, but very close tothe instability threshold (self-organised criticality), or else that the feedback intensity is itself timedependent and occasionally visits the unstable region. An alternative scenario is provided by a classof non-linear Hawkes process that show occasional "activated" liquidity crises, without having to bepoised at the edge of instability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice-mediated contagion with endogenous market liquidity

Zachary Feinstein, Zhiyu Cao

| Title | Authors | Year | Actions |

|---|

Comments (0)