Summary

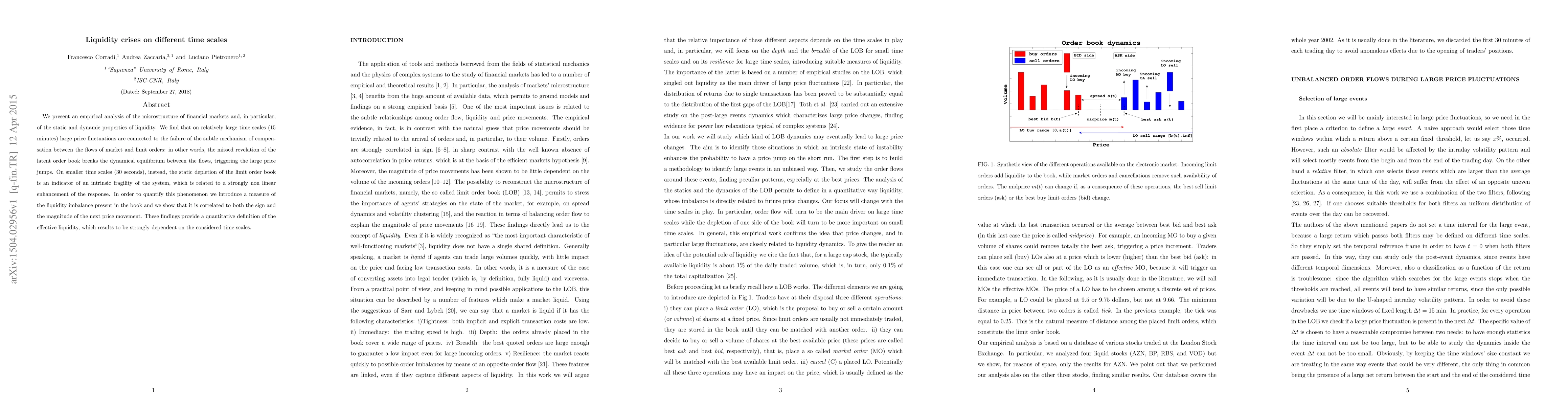

We present an empirical analysis of the microstructure of financial markets and, in particular, of the static and dynamic properties of liquidity. We find that on relatively large time scales (15 minutes) large price fluctuations are connected to the failure of the subtle mechanism of compensation between the flows of market and limit orders: in other words, the missed revelation of the latent order book breaks the dynamical equilibrium between the flows, triggering the large price jumps. On smaller time scales (30 seconds), instead, the static depletion of the limit order book is an indicator of an intrinsic fragility of the system, which is related to a strongly non linear enhancement of the response. In order to quantify this phenomenon we introduce a measure of the liquidity imbalance present in the book and we show that it is correlated to both the sign and the magnitude of the next price movement. These findings provide a quantitative definition of the effective liquidity, which results to be strongly dependent on the considered time scales.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)