Authors

Summary

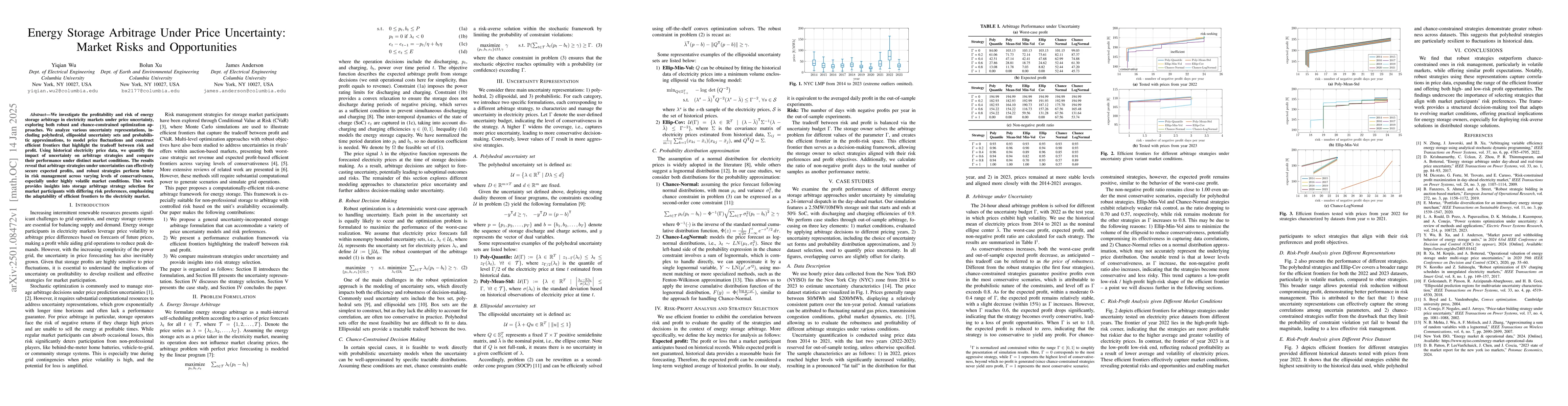

We investigate the profitability and risk of energy storage arbitrage in electricity markets under price uncertainty, exploring both robust and chance-constrained optimization approaches. We analyze various uncertainty representations, including polyhedral, ellipsoidal uncertainty sets and probabilistic approximations, to model price fluctuations and construct efficient frontiers that highlight the tradeoff between risk and profit. Using historical electricity price data, we quantify the impact of uncertainty on arbitrage strategies and compare their performance under distinct market conditions. The results reveal that arbitrage strategies under uncertainties can effectively secure expected profits, and robust strategies perform better in risk management across varying levels of conservativeness, especially under highly volatile market conditions. This work provides insights into storage arbitrage strategy selection for market participants with differing risk preferences, emphasizing the adaptability of efficient frontiers to the electricity market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersConformal Uncertainty Quantification of Electricity Price Predictions for Risk-Averse Storage Arbitrage

Ming Yi, Bolun Xu, Saud Alghumayjan

Energy Storage Price Arbitrage via Opportunity Value Function Prediction

Yuanyuan Shi, Bolun Xu, Ningkun Zheng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)