Summary

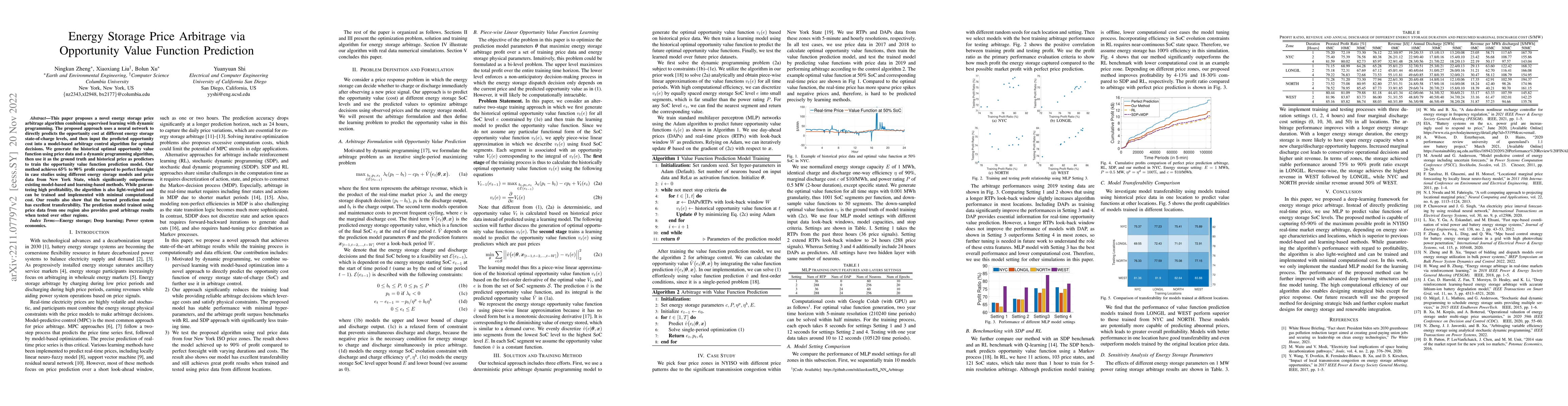

This paper proposes a novel energy storage price arbitrage algorithm combining supervised learning with dynamic programming. The proposed approach uses a neural network to directly predicts the opportunity cost at different energy storage state-of-charge levels, and then input the predicted opportunity cost into a model-based arbitrage control algorithm for optimal decisions. We generate the historical optimal opportunity value function using price data and a dynamic programming algorithm, then use it as the ground truth and historical price as predictors to train the opportunity value function prediction model. Our method achieves 65% to 90% profit compared to perfect foresight in case studies using different energy storage models and price data from New York State, which significantly outperforms existing model-based and learning-based methods. While guaranteeing high profitability, the algorithm is also light-weighted and can be trained and implemented with minimal computational cost. Our results also show that the learned prediction model has excellent transferability. The prediction model trained using price data from one region also provides good arbitrage results when tested over other regions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersElectricity Price Prediction for Energy Storage System Arbitrage: A Decision-focused Approach

Hongbin Sun, Huan Long, Linwei Sang et al.

Energy Storage Arbitrage Under Price Uncertainty: Market Risks and Opportunities

James Anderson, Bolun Xu, Yiqian Wu

Conformal Uncertainty Quantification of Electricity Price Predictions for Risk-Averse Storage Arbitrage

Ming Yi, Bolun Xu, Saud Alghumayjan

| Title | Authors | Year | Actions |

|---|

Comments (0)