Authors

Summary

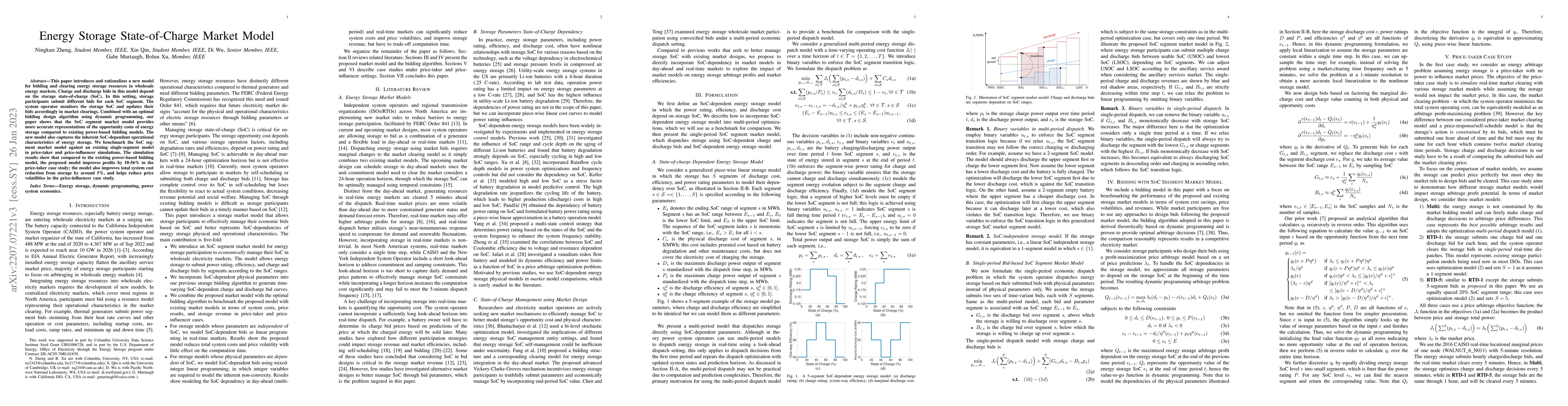

This paper introduces and rationalizes a new model for bidding and clearing energy storage resources in wholesale energy markets. Charge and discharge bids in this model depend on the storage state-of-charge (SoC). In this setting, storage participants submit different bids for each SoC segment. The system operator monitors the storage SoC and updates their bids accordingly in market clearings. Combined with an optimal bidding design algorithm using dynamic programming, our paper shows that the SoC segment market model provides more accurate representations of the opportunity costs of energy storage compared to existing power-based bidding models. The new model also captures the inherent SoC-dependent operational characteristics of energy storage. We benchmark the SoC segment market model against an existing single-segment model in price-taker and price-influencer simulations. The simulation results show that compared to the existing power-based bidding model, the proposed model improves profits by 10-56% in the price-taker case study; the model also improves total system cost reduction from storage by around 5%, and helps reduce price volatilities in the price-influencer case study.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWholesale Market Participation of Storage with State-of-Charge Dependent Bids

Cong Chen, Lang Tong

Effect of State of Charge Uncertainty on Battery Energy Storage Systems

Simona Onori, Ram Rajagopal, Sonia Martin

| Title | Authors | Year | Actions |

|---|

Comments (0)