Summary

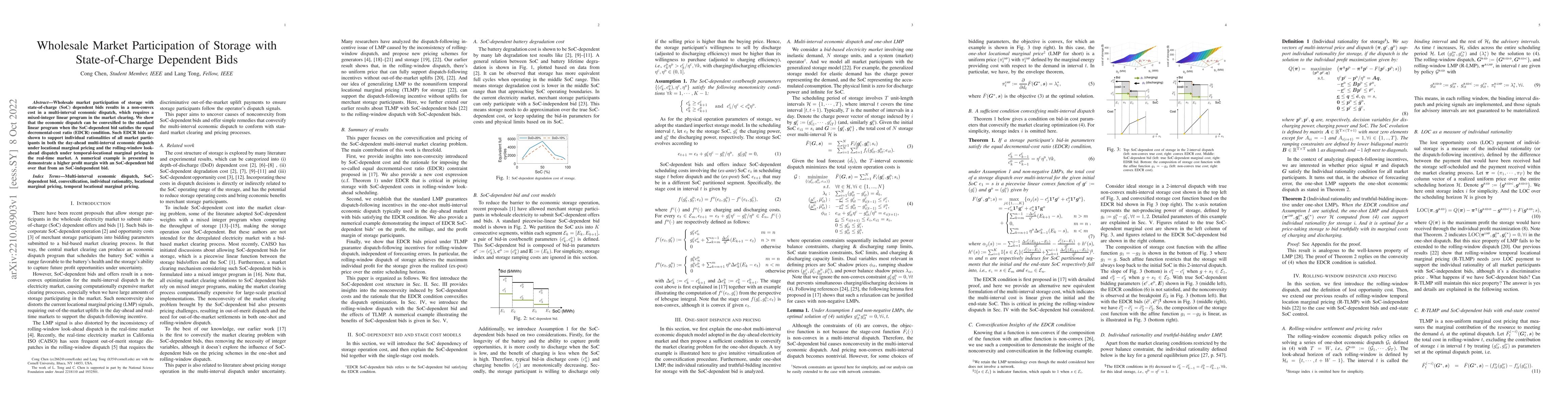

Wholesale market participation of storage with state-of-charge (SoC) dependent bids results in a non-convex cost in a multi-interval economic dispatch, which requires a mixed-integer linear program in the market clearing. We show that the economic dispatch can be convexified to the standard linear program when the SoC-dependent bid satisfies the equal decremental-cost ratio (EDCR) condition. Such EDCR bids are shown to support individual rationalities of all market participants in both the day-ahead multi-interval economic dispatch under locational marginal pricing and the rolling-window look-ahead dispatch under temporal-locational marginal pricing in the real-time market. A numerical example is presented to demonstrate a higher profit margin with an SoC-dependent bid over that from an SoC-independent bid.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWholesale Market Participation of DERA: Competitive DER Aggregation

Cong Chen, Ahmed S. Alahmed, Timothy D. Mount et al.

Convexifying Market Clearing of SoC-Dependent Bids from Merchant Storage Participants

Cong Chen, Lang Tong

Convexifying Regulation Market Clearing of State-of-Charge Dependent Bid

Cong Chen, Lang Tong, Siying Li

| Title | Authors | Year | Actions |

|---|

Comments (0)