Summary

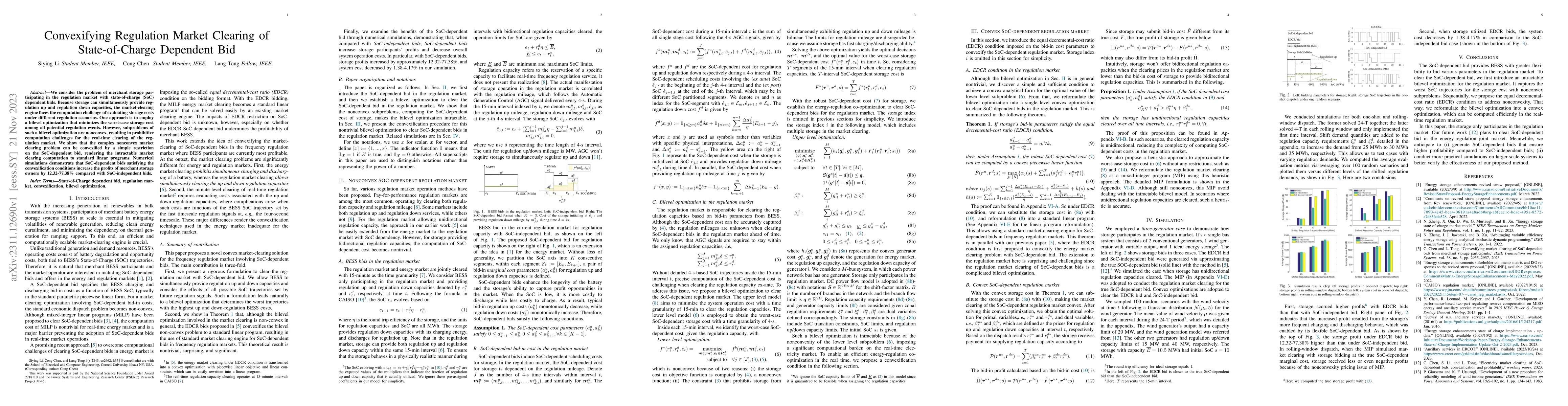

We consider the problem of merchant storage participating in the regulation market with state-of-charge (SoC) dependent bids. Because storage can simultaneously provide regulation up and regulation down capacities, the market-clearing engine faces the computation challenge of evaluating storage costs under different regulation scenarios. One approach is to employ a bilevel optimization that minimizes the worst-case storage cost among all potential regulation events. However, subproblems of such a bilevel optimization are nonconvex, resulting in prohibitive computation challenges for the real-time clearing of the regulation market. We show that the complex nonconvex market clearing problem can be convexified by a simple restriction on the SoC-dependent bid, rendering the intractable market clearing computation to standard linear programs. Numerical simulations demonstrate that SoC-dependent bids satisfying the convexification conditions increase the profits of merchant storage owners by 12.32-77.38% compared with SoC-independent bids.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConvexifying Market Clearing of SoC-Dependent Bids from Merchant Storage Participants

Cong Chen, Lang Tong

Wholesale Market Participation of Storage with State-of-Charge Dependent Bids

Cong Chen, Lang Tong

| Title | Authors | Year | Actions |

|---|

Comments (0)