Summary

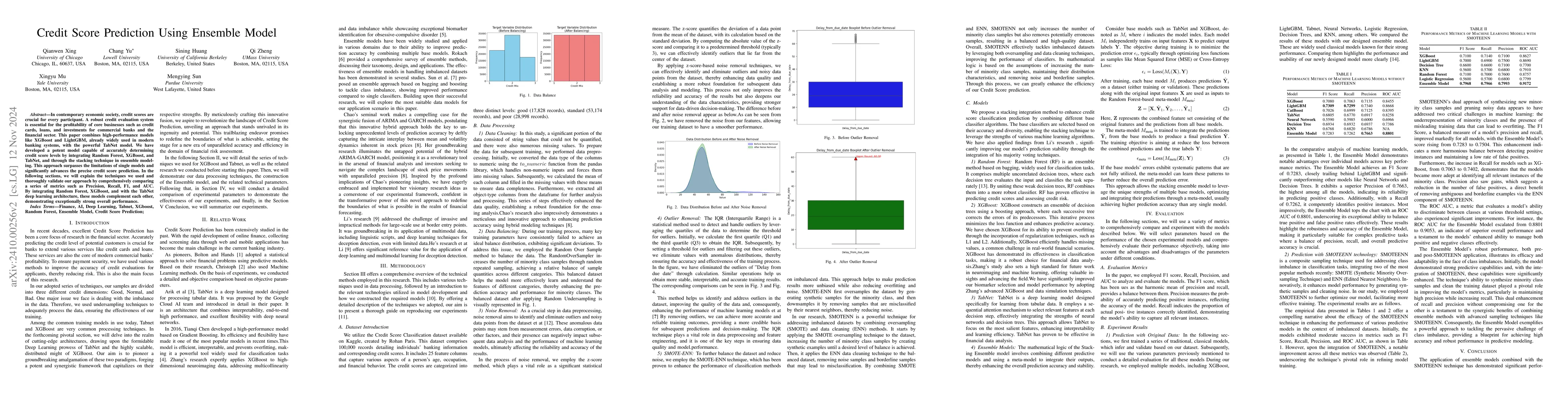

In contemporary economic society, credit scores are crucial for every participant. A robust credit evaluation system is essential for the profitability of core businesses such as credit cards, loans, and investments for commercial banks and the financial sector. This paper combines high-performance models like XGBoost and LightGBM, already widely used in modern banking systems, with the powerful TabNet model. We have developed a potent model capable of accurately determining credit score levels by integrating Random Forest, XGBoost, and TabNet, and through the stacking technique in ensemble modeling. This approach surpasses the limitations of single models and significantly advances the precise credit score prediction. In the following sections, we will explain the techniques we used and thoroughly validate our approach by comprehensively comparing a series of metrics such as Precision, Recall, F1, and AUC. By integrating Random Forest, XGBoost, and with the TabNet deep learning architecture, these models complement each other, demonstrating exceptionally strong overall performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInterpretable Credit Default Prediction with Ensemble Learning and SHAP

Shiqi Yang, Xinyu Shen, Ziyi Huang et al.

Credit card score prediction using machine learning models: A new dataset

Alaa Sulaiman, Anas Arram, Masri Ayob et al.

An Integrated Machine Learning and Deep Learning Framework for Credit Card Approval Prediction

Yijing Wei, Yanxin Shen, Yujian Long et al.

Ensemble Methodology:Innovations in Credit Default Prediction Using LightGBM, XGBoost, and LocalEnsemble

Ye Zhang, Xu Yan, Yulu Gong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)