Authors

Summary

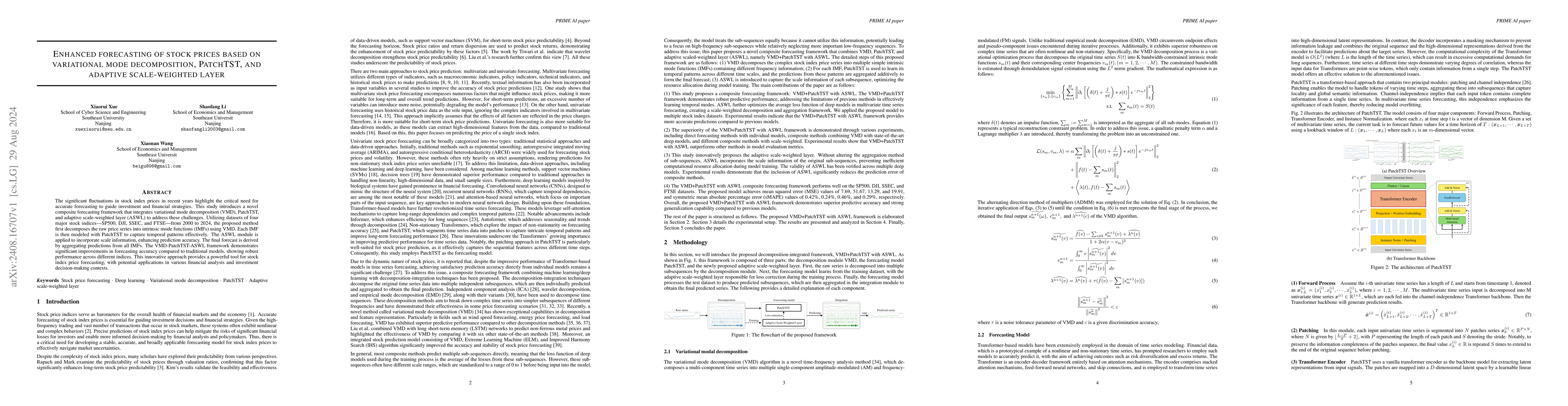

The significant fluctuations in stock index prices in recent years highlight the critical need for accurate forecasting to guide investment and financial strategies. This study introduces a novel composite forecasting framework that integrates variational mode decomposition (VMD), PatchTST, and adaptive scale-weighted layer (ASWL) to address these challenges. Utilizing datasets of four major stock indices--SP500, DJI, SSEC, and FTSE--from 2000 to 2024, the proposed method first decomposes the raw price series into intrinsic mode functions (IMFs) using VMD. Each IMF is then modeled with PatchTST to capture temporal patterns effectively. The ASWL module is applied to incorporate scale information, enhancing prediction accuracy. The final forecast is derived by aggregating predictions from all IMFs. The VMD-PatchTST-ASWL framework demonstrates significant improvements in forecasting accuracy compared to traditional models, showing robust performance across different indices. This innovative approach provides a powerful tool for stock index price forecasting, with potential applications in various financial analysis and investment decision-making contexts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhanced forecasting of shipboard electrical power demand using multivariate input and variational mode decomposition with mode selection.

Fazzini, Paolo, La Tona, Giuseppe, Diez, Matteo et al.

Multi-step-ahead Stock Price Prediction Using Recurrent Fuzzy Neural Network and Variational Mode Decomposition

Hamid Nasiri, Mohammad Mehdi Ebadzadeh

No citations found for this paper.

Comments (0)