Summary

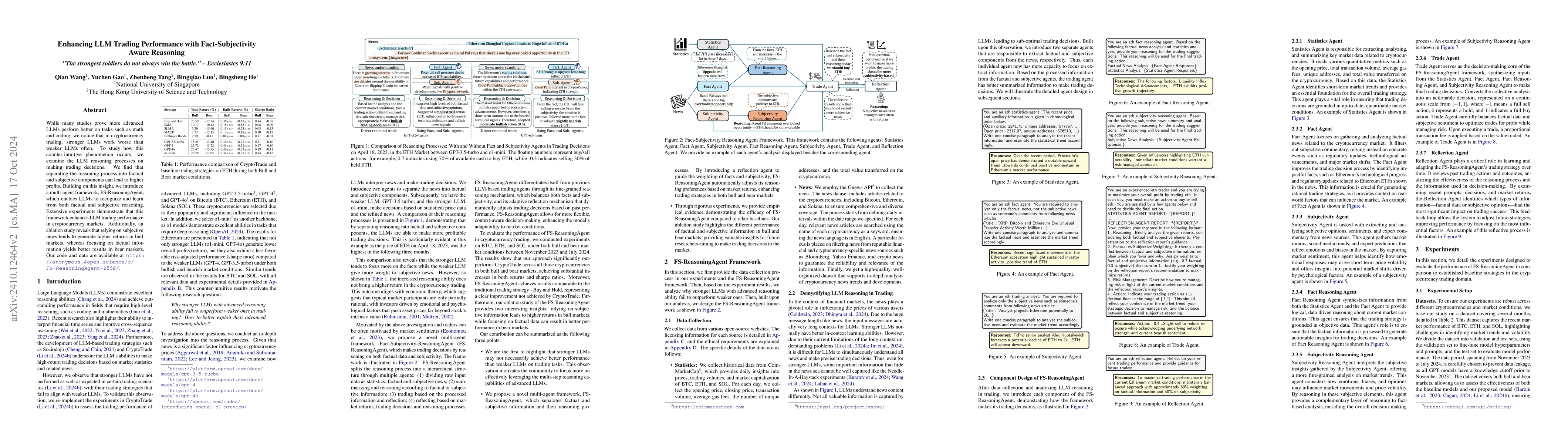

While many studies prove more advanced LLMs perform better on tasks such as math and coding, we notice that in cryptocurrency trading, stronger LLMs work worse than weaker LLMs often. To study how this counter-intuitive phenomenon occurs, we examine the LLM reasoning processes on making trading decisions. We find that separating the reasoning process into factual and subjective components can lead to higher profits. Building on this insight, we introduce a multi-agent framework, FS-ReasoningAgent, which enables LLMs to recognize and learn from both factual and subjective reasoning. Extensive experiments demonstrate that this framework enhances LLM trading performance in cryptocurrency markets. Additionally, an ablation study reveals that relying on subjective news tends to generate higher returns in bull markets, whereas focusing on factual information yields better results in bear markets. Our code and data are available at \url{https://anonymous.4open.science/r/FS-ReasoningAgent-B55F/}.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrading-R1: Financial Trading with LLM Reasoning via Reinforcement Learning

Wei Wang, Tong Chen, Di Luo et al.

Token-Budget-Aware LLM Reasoning

Shiqing Ma, Zhenting Wang, Chunrong Fang et al.

FinMem: A Performance-Enhanced LLM Trading Agent with Layered Memory and Character Design

Yang Li, Yangyang Yu, Haohang Li et al.

No citations found for this paper.

Comments (0)