Authors

Summary

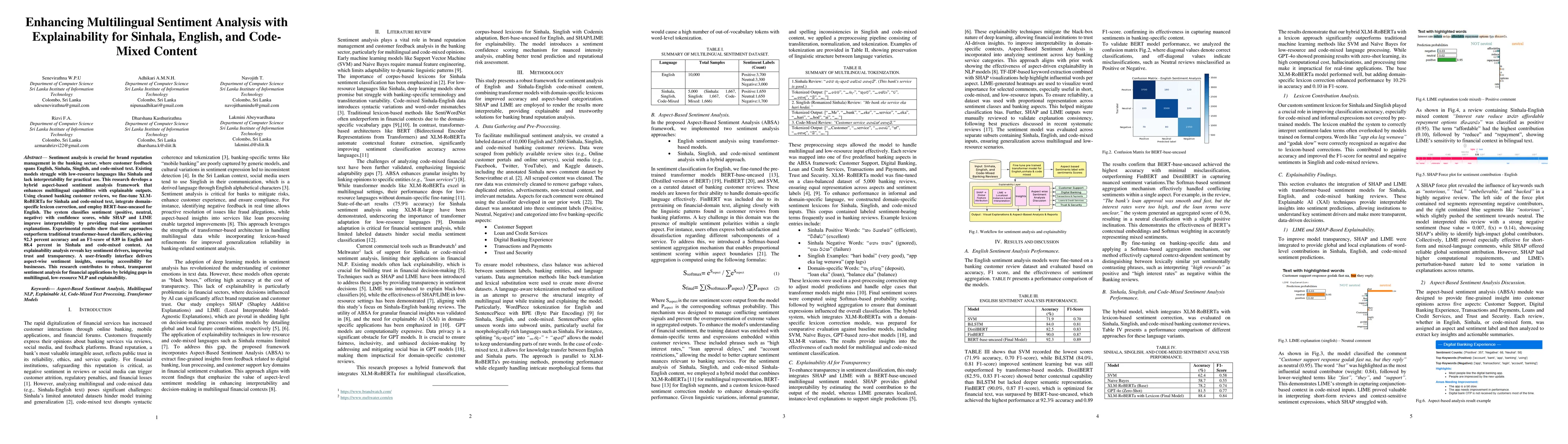

Sentiment analysis is crucial for brand reputation management in the banking sector, where customer feedback spans English, Sinhala, Singlish, and code-mixed text. Existing models struggle with low-resource languages like Sinhala and lack interpretability for practical use. This research develops a hybrid aspect-based sentiment analysis framework that enhances multilingual capabilities with explainable outputs. Using cleaned banking customer reviews, we fine-tune XLM-RoBERTa for Sinhala and code-mixed text, integrate domain-specific lexicon correction, and employ BERT-base-uncased for English. The system classifies sentiment (positive, neutral, negative) with confidence scores, while SHAP and LIME improve interpretability by providing real-time sentiment explanations. Experimental results show that our approaches outperform traditional transformer-based classifiers, achieving 92.3 percent accuracy and an F1-score of 0.89 in English and 88.4 percent in Sinhala and code-mixed content. An explainability analysis reveals key sentiment drivers, improving trust and transparency. A user-friendly interface delivers aspect-wise sentiment insights, ensuring accessibility for businesses. This research contributes to robust, transparent sentiment analysis for financial applications by bridging gaps in multilingual, low-resource NLP and explainability.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research methodology involved creating a labeled dataset of 10,000 English and 5,000 Sinhala, Singlish, and code-mixed banking customer reviews. Data was cleaned, tokenized using language-aware methods, and annotated into three sentiment labels and five banking-specific aspects. A hybrid Aspect-Based Sentiment Analysis (ABSA) framework was implemented, combining transformer models with domain-specific lexicons for improved accuracy and aspect-based categorization. SHAP and LIME were employed for explainability.

Key Results

- The hybrid model achieved 92.3% accuracy and an F1-score of 0.89 for English sentiment analysis, outperforming traditional transformer-based classifiers.

- For Sinhala, Singlish, and code-mixed content, the model obtained 88.4% accuracy with an F1-score of 0.84, significantly improving upon baseline models like SVM and Naive Bayes.

- Explainability techniques, SHAP and LIME, provided real-time sentiment explanations, improving trust and transparency in the system.

Significance

This research contributes to robust, transparent sentiment analysis for financial applications by bridging gaps in multilingual, low-resource NLP and explainability, which is crucial for brand reputation management in the banking sector.

Technical Contribution

The main technical contribution is a hybrid aspect-based sentiment analysis framework that integrates XLM-RoBERTa for multilingual classification, corpus-based lexicons for Sinhala, Singlish with Codemix adaptation, BERT-base-uncased for English, and SHAP/LIME for explainability.

Novelty

This work is novel in its approach to enhancing multilingual sentiment analysis with explainability for Sinhala, English, and code-mixed content, addressing the challenges of low-resource languages and the need for interpretability in practical use.

Limitations

- Handling negation, slang, and code-mixed expressions remains challenging due to structural complexity and limited linguistic patterns.

- The Aspect-Based Sentiment Analysis module struggled with reviews containing multiple sentiments within a single aspect, long reviews with conflicting sentiments, and code-mix content requires better aggregation techniques for accurate sentiment scoring.

- The absence of large-scale annotated datasets for Sinhala, Singlish, and code-mixed sentiment analysis, particularly within the financial domain, limited the model’s ability to generalize across diverse edge cases and informal expressions.

Future Work

- Future research can build on this foundation by incorporating multimodal sentiment analysis using audio and video cues.

- Extending the approach to other low-resource languages like Tamil and other domains is suggested.

- Leveraging few-shot and zero-shot learning with generative AI could improve performance in data-scarce environments.

- Fairness and bias evaluations will be essential to ensure ethical and inclusive sentiment classification.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKeyword Extraction, and Aspect Classification in Sinhala, English, and Code-Mixed Content

Lakmini Abeywardhana, Dharshana Kasthurirathna, A. M. N. H. Adhikari et al.

BnSentMix: A Diverse Bengali-English Code-Mixed Dataset for Sentiment Analysis

Md Farhan Ishmam, Sadia Alam, Navid Hasin Alvee et al.

No citations found for this paper.

Comments (0)