Summary

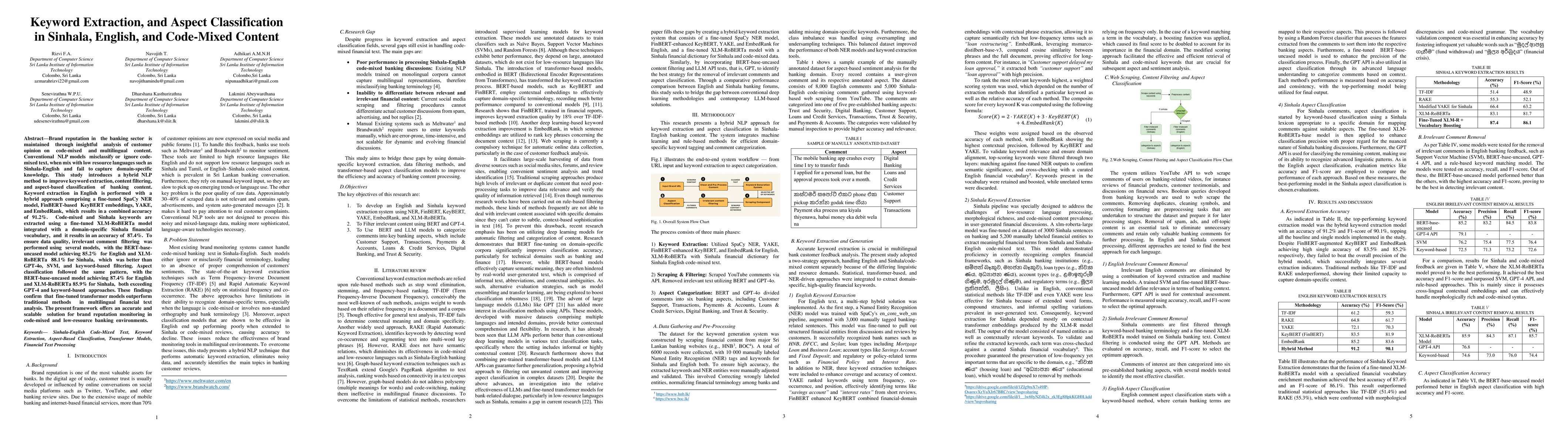

Brand reputation in the banking sector is maintained through insightful analysis of customer opinion on code-mixed and multilingual content. Conventional NLP models misclassify or ignore code-mixed text, when mix with low resource languages such as Sinhala-English and fail to capture domain-specific knowledge. This study introduces a hybrid NLP method to improve keyword extraction, content filtering, and aspect-based classification of banking content. Keyword extraction in English is performed with a hybrid approach comprising a fine-tuned SpaCy NER model, FinBERT-based KeyBERT embeddings, YAKE, and EmbedRank, which results in a combined accuracy of 91.2%. Code-mixed and Sinhala keywords are extracted using a fine-tuned XLM-RoBERTa model integrated with a domain-specific Sinhala financial vocabulary, and it results in an accuracy of 87.4%. To ensure data quality, irrelevant comment filtering was performed using several models, with the BERT-base-uncased model achieving 85.2% for English and XLM-RoBERTa 88.1% for Sinhala, which was better than GPT-4o, SVM, and keyword-based filtering. Aspect classification followed the same pattern, with the BERT-base-uncased model achieving 87.4% for English and XLM-RoBERTa 85.9% for Sinhala, both exceeding GPT-4 and keyword-based approaches. These findings confirm that fine-tuned transformer models outperform traditional methods in multilingual financial text analysis. The present framework offers an accurate and scalable solution for brand reputation monitoring in code-mixed and low-resource banking environments.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research presents a hybrid NLP approach for keyword extraction and aspect classification in Sinhala-English banking content, integrating machine learning and rule-based methods for domain-specific keyword tagging and comment categorization.

Key Results

- The hybrid keyword extraction model achieved an accuracy of 91.2% and F1-score of 90.1% for English, outperforming traditional methods and single models.

- For Sinhala, the fine-tuned XLM-RoBERTa model with a specialized financial vocabulary enrichment mechanism achieved an accuracy of 87.4% and F1-score of 86.1%, surpassing traditional statistical approaches.

- BERT-base-uncased model performed best in English aspect classification with high accuracy and F1-score, while XLM-RoBERTa-base performed best for Sinhala and code-mixed data.

- BERT-base-uncased and XLM-RoBERTa outperformed GPT-4 API and baseline models in accuracy and reliability for both keyword extraction and aspect classification tasks.

Significance

This study offers a robust multilingual brand reputation monitoring system tailored for the banking sector, focusing on automated keyword extraction, irrelevant content filtering, and aspect classification, which is crucial for maintaining brand reputation in code-mixed and low-resource banking environments.

Technical Contribution

The research introduces a hybrid keyword extraction system that combines a fine-tuned SpaCy NER model, FinBERT-enhanced KeyBERT, YAKE, and EmbedRank for English, and a fine-tuned XLM-RoBERTa model with a Sinhala financial dictionary for Sinhala and code-mixed data.

Novelty

The study bridges the gap between conventional deep learning methodologies and contemporary LLM-based solutions by creating a hybrid keyword extraction system and comparing its performance against English and Sinhala banking forums.

Limitations

- The lack of high-quality annotated Sinhala financial datasets restricts deeper model training.

- Code-mixed Sinhala-English content remains challenging due to its informal structure and limited labeled data.

- Transformer models, while accurate, are computationally intensive and less efficient with lengthy texts.

- Web scraping introduces noise, requiring improved filtering techniques.

Future Work

- Integration of a sentiment classification module for Sinhala-English financial discussions to facilitate aspect-based sentiment analysis end-to-end.

- Incorporation of explainability measures using SHAP and LIME methods to enhance model transparency and stakeholder trust.

- Expansion of the system to support Tamil and other low-resource languages for regional acceptability.

- Improvement of social media scraping capabilities to include platforms like Facebook and Twitter for real-time harvesting of multilingual financial feedback.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancing Multilingual Sentiment Analysis with Explainability for Sinhala, English, and Code-Mixed Content

Lakmini Abeywardhana, Dharshana Kasthurirathna, Azmarah Rizvi et al.

Adapting the Tesseract Open-Source OCR Engine for Tamil and Sinhala Legacy Fonts and Creating a Parallel Corpus for Tamil-Sinhala-English

Uthayasanker Thayasivam, Charangan Vasantharajan, Laksika Tharmalingam

| Title | Authors | Year | Actions |

|---|

Comments (0)