Summary

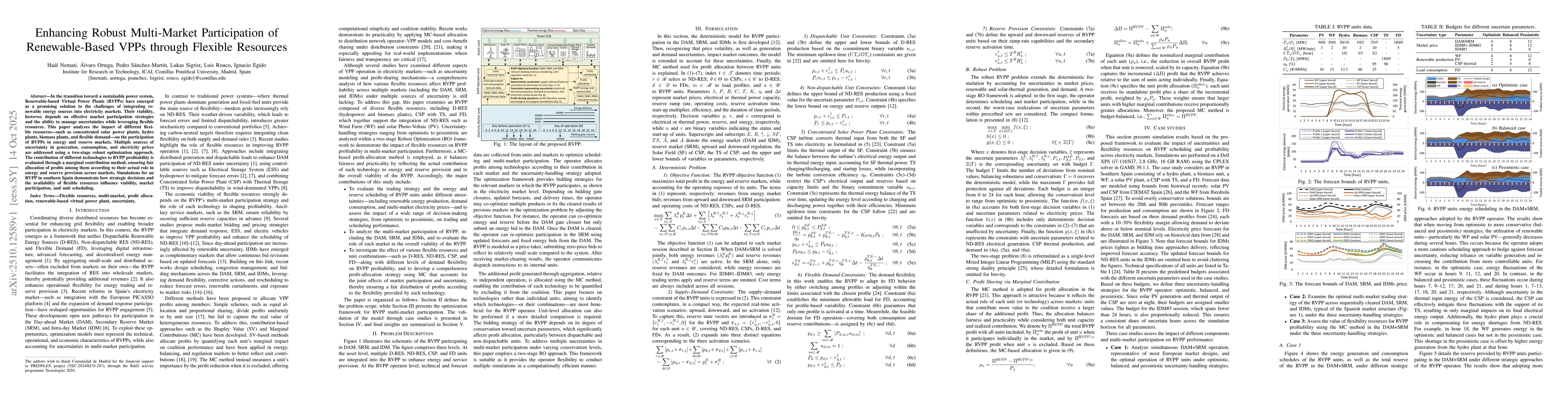

In the transition toward a sustainable power system, renewable-based Virtual Power Plants (RVPPs) have emerged as a promising solution to the challenges of integrating renewable energy sources into electricity markets. Their viability, however, depends on effective market participation strategies and the ability to manage uncertainties while leveraging flexible resources. This paper analyzes the impact of different flexible resources - such as concentrated solar power plants, hydro plants, biomass plants, and flexible demand - on the participation of RVPPs in energy and reserve markets. Multiple sources of uncertainty in generation, consumption, and electricity prices are addressed using a two-stage robust optimization approach. The contribution of different technologies to RVPP profitability is evaluated through a marginal contribution method, ensuring fair allocation of profits among them according to their actual role in energy and reserve provision across markets. Simulations for an RVPP in southern Spain demonstrate how strategic decisions and the availability of flexible resources influence viability, market participation, and unit scheduling.

AI Key Findings

Generated Oct 30, 2025

Methodology

The research employs a two-stage robust optimization approach to model uncertainties in energy and reserve markets, renewable generation, and demand consumption. It integrates a marginal contribution method for profit allocation among virtual power plant units.

Key Results

- The study shows that higher demand flexibility significantly increases RVPP profits under conservative strategies.

- Conservative strategies reduce energy sold and increase energy purchased, enhancing robustness against worst-case scenarios.

- D-RES and FD provide the highest normalized contributions to RVPP profitability across all strategies.

Significance

This research provides critical insights into optimizing virtual power plant operations in uncertain markets, supporting more resilient and profitable renewable energy integration.

Technical Contribution

Development of a two-stage robust optimization framework combined with a marginal contribution method for profit allocation in multi-market VPP operations.

Novelty

The integration of demand flexibility and thermal storage management within a robust optimization framework for VPPs represents a novel approach to handling market and operational uncertainties.

Limitations

- The analysis assumes fixed demand flexibility levels without dynamic adjustments.

- It focuses on a specific geographic region (Spain) which may limit generalizability.

Future Work

- Investigating dynamic demand flexibility adjustments in real-time markets.

- Exploring the integration of more advanced storage technologies with VPPs.

Paper Details

PDF Preview

Similar Papers

Found 5 papersEnabling Grid-Aware Market Participation of Aggregate Flexible Resources

Andrey Bernstein, Ahmed Zamzam, Bai Cui

Assessing Value of Renewable-based VPP Versus Electrical Storage: Multi-market Participation Under Different Scheduling Regimes and Uncertainties

Hadi Nemati, Pedro Sánchez-Martín, Álvaro Ortega et al.

DRL-Based Medium-Term Planning of Renewable-Integrated Self-Scheduling Cascaded Hydropower to Guide Wholesale Market Participation

Lei Wu, Neng Fan, Xianbang Chen et al.

Analyzing the Role of the DSO in Electricity Trading of VPPs via a Stackelberg Game Model

Xi Zhang, Peng Wang, Luis Badesa

Comments (0)