Summary

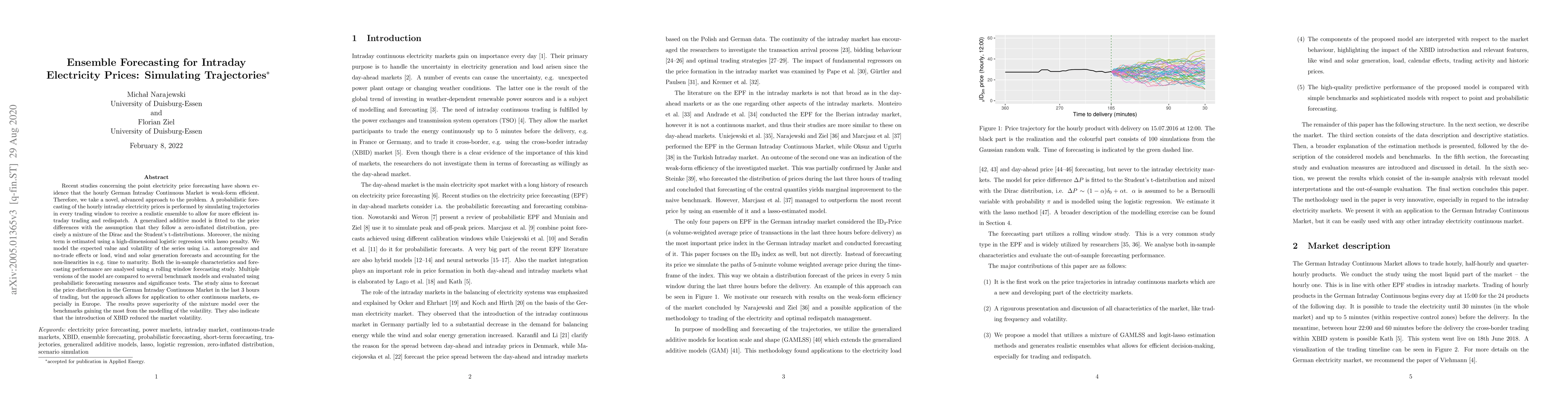

Recent studies concerning the point electricity price forecasting have shown evidence that the hourly German Intraday Continuous Market is weak-form efficient. Therefore, we take a novel, advanced approach to the problem. A probabilistic forecasting of the hourly intraday electricity prices is performed by simulating trajectories in every trading window to receive a realistic ensemble to allow for more efficient intraday trading and redispatch. A generalized additive model is fitted to the price differences with the assumption that they follow a zero-inflated distribution, precisely a mixture of the Dirac and the Student's t-distributions. Moreover, the mixing term is estimated using a high-dimensional logistic regression with lasso penalty. We model the expected value and volatility of the series using i.a. autoregressive and no-trade effects or load, wind and solar generation forecasts and accounting for the non-linearities in e.g. time to maturity. Both the in-sample characteristics and forecasting performance are analysed using a rolling window forecasting study. Multiple versions of the model are compared to several benchmark models and evaluated using probabilistic forecasting measures and significance tests. The study aims to forecast the price distribution in the German Intraday Continuous Market in the last 3 hours of trading, but the approach allows for application to other continuous markets, especially in Europe. The results prove superiority of the mixture model over the benchmarks gaining the most from the modelling of the volatility. They also indicate that the introduction of XBID reduced the market volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)