Authors

Summary

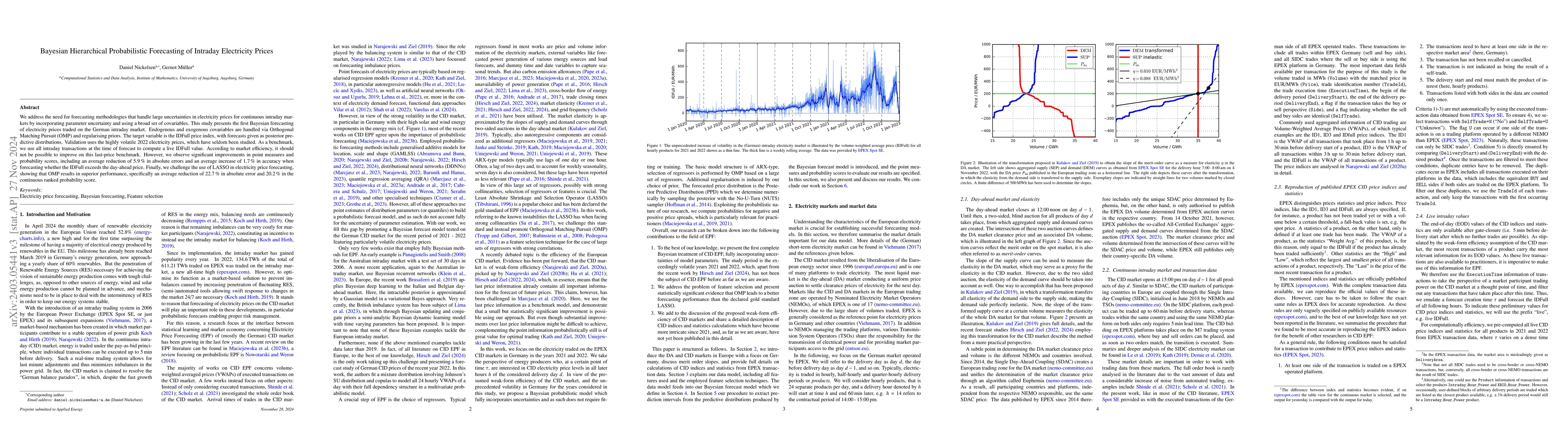

We present a first study of Bayesian forecasting of electricity prices traded on the German continuous intraday market which fully incorporates parameter uncertainty. Our target variable is the IDFull price index, forecasts are given in terms of posterior predictive distributions. For validation we use the exceedingly volatile electricity prices of 2022, which have hardly been the subject of forecasting studies before. As a benchmark model, we use all available intraday transactions at the time of forecast creation to compute a current value for the IDFull. According to the weak-form efficiency hypothesis, it would not be possible to significantly improve this benchmark built from last price information. We do, however, observe statistically significant improvement in terms of both point measures and probability scores. Finally, we challenge the declared gold standard of using LASSO for feature selection in electricity price forecasting by presenting strong statistical evidence that Orthogonal Matching Pursuit (OMP) leads to better forecasting performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProbabilistic forecasting of German electricity imbalance prices

Michał Narajewski

Deep Distributional Time Series Models and the Probabilistic Forecasting of Intraday Electricity Prices

Michael Stanley Smith, David J. Nott, Nadja Klein

Multivariate Probabilistic Forecasting of Intraday Electricity Prices using Normalizing Flows

Alexander Mitsos, Dirk Witthaut, Manuel Dahmen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)