Summary

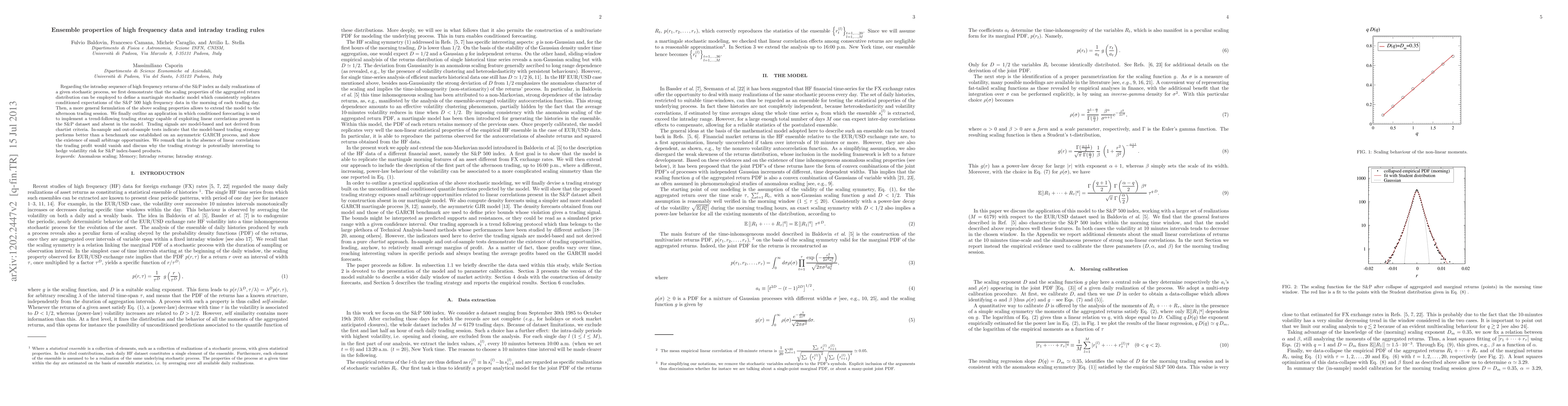

Regarding the intraday sequence of high frequency returns of the S&P index as daily realizations of a given stochastic process, we first demonstrate that the scaling properties of the aggregated return distribution can be employed to define a martingale stochastic model which consistently replicates conditioned expectations of the S&P 500 high frequency data in the morning of each trading day. Then, a more general formulation of the above scaling properties allows to extend the model to the afternoon trading session. We finally outline an application in which conditioned forecasting is used to implement a trend-following trading strategy capable of exploiting linear correlations present in the S&P dataset and absent in the model. Trading signals are model-based and not derived from chartist criteria. In-sample and out-of-sample tests indicate that the model-based trading strategy performs better than a benchmark one established on an asymmetric GARCH process, and show the existence of small arbitrage opportunities. We remark that in the absence of linear correlations the trading profit would vanish and discuss why the trading strategy is potentially interesting to hedge volatility risk for S&P index-based products.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMaximizing Battery Storage Profits via High-Frequency Intraday Trading

Thorsten Staake, Nils Löhndorf, David Wozabal et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)