Summary

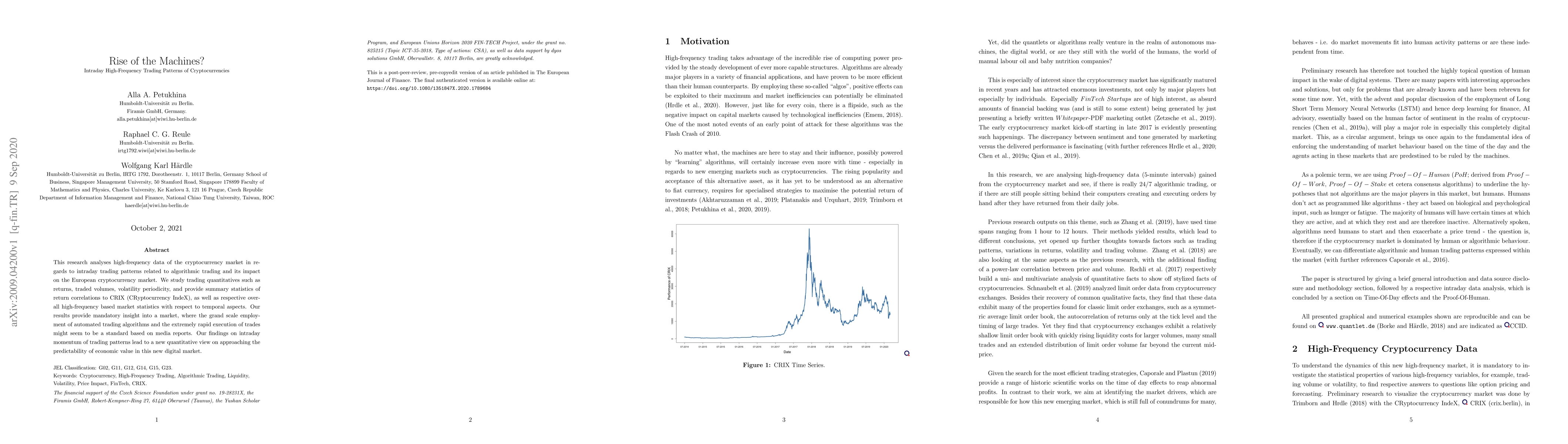

This research analyses high-frequency data of the cryptocurrency market in regards to intraday trading patterns related to algorithmic trading and its impact on the European cryptocurrency market. We study trading quantitatives such as returns, traded volumes, volatility periodicity, and provide summary statistics of return correlations to CRIX (CRyptocurrency IndeX), as well as respective overall high-frequency based market statistics with respect to temporal aspects. Our results provide mandatory insight into a market, where the grand scale employment of automated trading algorithms and the extremely rapid execution of trades might seem to be a standard based on media reports. Our findings on intraday momentum of trading patterns lead to a new quantitative view on approaching the predictability of economic value in this new digital market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMaximizing Battery Storage Profits via High-Frequency Intraday Trading

Thorsten Staake, Nils Löhndorf, David Wozabal et al.

Probabilistic Multi-product Trading in Sequential Intraday and Frequency-Regulation Markets

Mohammad Reza Hesamzadeh, Saeed Nordin, Abolfazl Khodadadi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)