Authors

Summary

This paper presents a comprehensive study on the use of ensemble Reinforcement Learning (RL) models in financial trading strategies, leveraging classifier models to enhance performance. By combining RL algorithms such as A2C, PPO, and SAC with traditional classifiers like Support Vector Machines (SVM), Decision Trees, and Logistic Regression, we investigate how different classifier groups can be integrated to improve risk-return trade-offs. The study evaluates the effectiveness of various ensemble methods, comparing them with individual RL models across key financial metrics, including Cumulative Returns, Sharpe Ratios (SR), Calmar Ratios, and Maximum Drawdown (MDD). Our results demonstrate that ensemble methods consistently outperform base models in terms of risk-adjusted returns, providing better management of drawdowns and overall stability. However, we identify the sensitivity of ensemble performance to the choice of variance threshold {\tau}, highlighting the importance of dynamic {\tau} adjustment to achieve optimal performance. This study emphasizes the value of combining RL with classifiers for adaptive decision-making, with implications for financial trading, robotics, and other dynamic environments.

AI Key Findings

Generated Jun 11, 2025

Methodology

This study employs ensemble Reinforcement Learning (RL) models combined with traditional classifiers like SVM, Decision Trees, and Logistic Regression to enhance risk-return trade-offs in financial trading strategies. The effectiveness of various ensemble methods is evaluated against individual RL models using metrics such as Cumulative Returns, Sharpe Ratios, Calmar Ratios, and Maximum Drawdown.

Key Results

- Ensemble methods consistently outperform base RL models in terms of risk-adjusted returns.

- Ensembles demonstrate better management of drawdowns and overall stability in trading strategies.

- The study identifies sensitivity of ensemble performance to the choice of variance threshold \(\tau\), emphasizing the need for dynamic \(\tau\) adjustment.

- The research highlights the value of combining RL with classifiers for adaptive decision-making in financial trading and other dynamic environments.

Significance

The findings of this research are significant as they showcase the potential of ensemble RL models integrated with traditional classifiers to improve financial trading strategies by optimizing risk-return trade-offs. This approach can lead to more robust and stable trading algorithms, which are crucial in volatile financial markets.

Technical Contribution

The paper presents a novel ensemble approach that combines RL algorithms (A2C, PPO, SAC) with traditional classifiers (SVM, Decision Trees, Logistic Regression) to enhance trading strategies, providing a robust framework for risk-return optimization.

Novelty

This work stands out by demonstrating the effectiveness of integrating diverse machine learning models through ensemble methods to improve financial trading strategies, offering a comprehensive analysis of various classifier groups and their combinations.

Limitations

- The study is limited by the specific financial environment simulated in the FinRL environment, which may not fully capture real-world market complexities.

- The sensitivity to the variance threshold \(\tau\) indicates that optimal performance heavily relies on its careful selection.

Future Work

- Future research could focus on developing adaptive methods for dynamically selecting \(\tau\) based on real-time market conditions or volatility.

- Exploration of ensemble methods in other domains such as robotics, autonomous systems, and healthcare where dynamic decision-making is essential.

Paper Details

PDF Preview

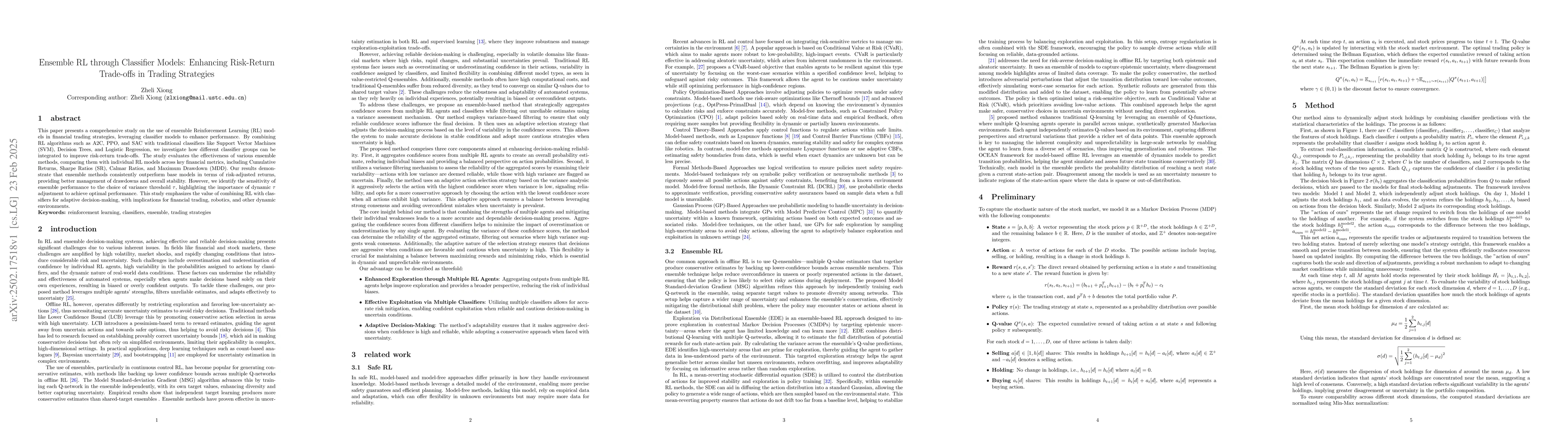

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancing Privacy-Utility Trade-offs to Mitigate Memorization in Diffusion Models

Mubarak Shah, Chen Chen, Chang Xu et al.

Replication of Reference-Dependent Preferences and the Risk-Return Trade-Off in the Chinese Market

Penggan Xu

Performance Trade-offs of Watermarking Large Language Models

Sameer Singh, Anirudh Ajith, Danish Pruthi

No citations found for this paper.

Comments (0)