Summary

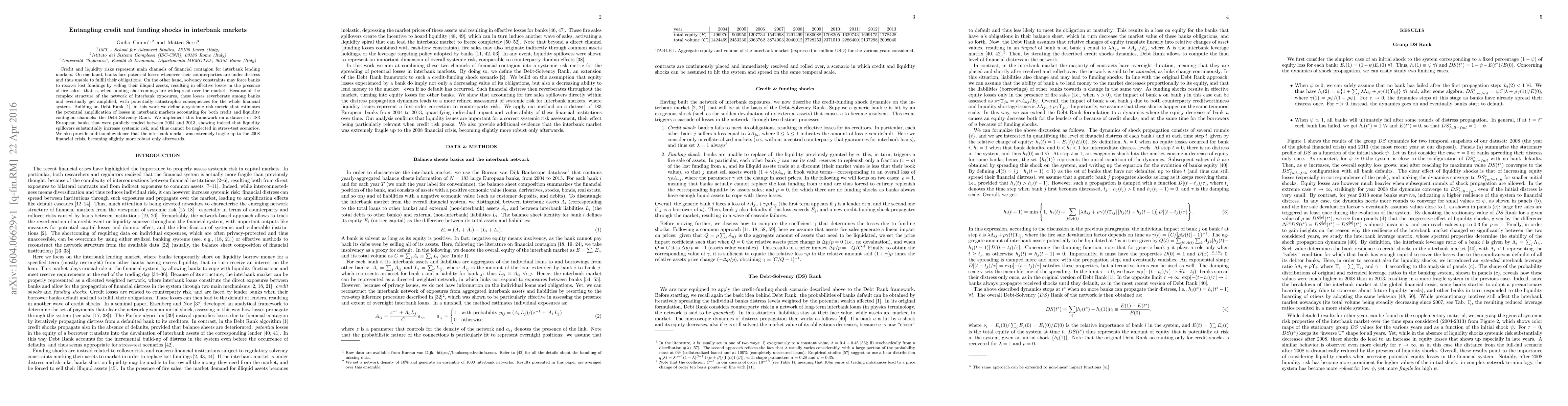

Credit and liquidity risks represent main channels of financial contagion for interbank lending markets. On one hand, banks face potential losses whenever their counterparties are under distress and thus unable to fulfill their obligations. On the other hand, solvency constraints may force banks to recover lost fundings by selling their illiquid assets, resulting in effective losses in the presence of fire sales - that is, when funding shortcomings are widespread over the market. Because of the complex structure of the network of interbank exposures, these losses reverberate among banks and eventually get amplified, with potentially catastrophic consequences for the whole financial system. Building on Debt Rank [Battiston et al., 2012], in this work we define a systemic risk metric that estimates the potential amplification of losses in interbank markets accounting for both credit and liquidity contagion channels: the Debt-Solvency Rank. We implement this framework on a dataset of 183 European banks that were publicly traded between 2004 and 2013, showing indeed that liquidity spillovers substantially increase systemic risk, and thus cannot be neglected in stress-test scenarios. We also provide additional evidence that the interbank market was extremely fragile up to the 2008 financial crisis, becoming slightly more robust only afterwards.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)