Authors

Summary

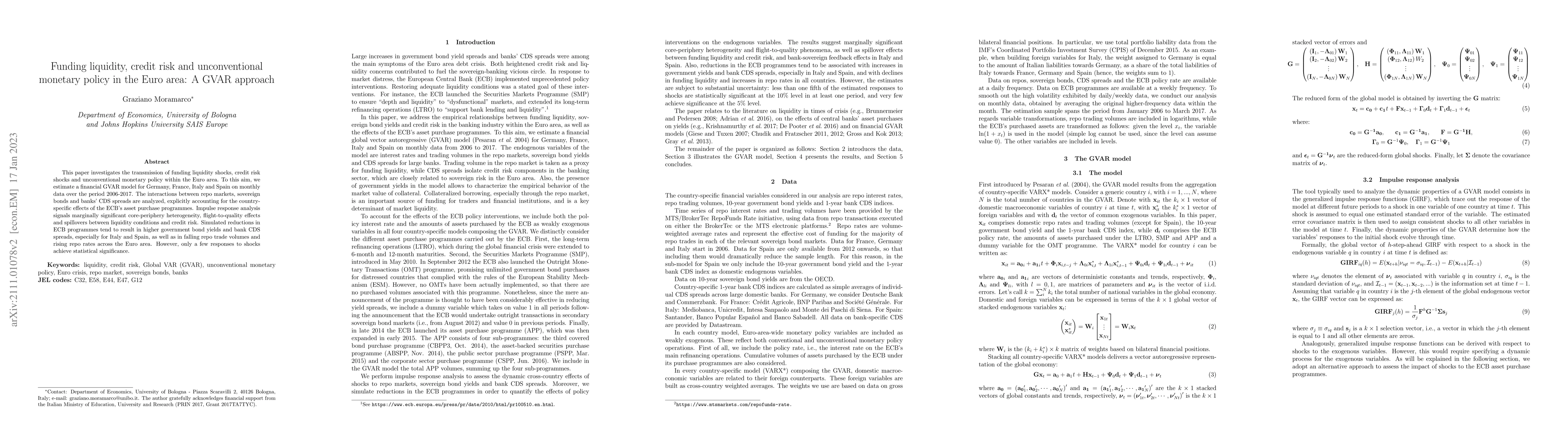

This paper investigates the transmission of funding liquidity shocks, credit risk shocks and unconventional monetary policy within the Euro area. To this aim, we estimate a financial GVAR model for Germany, France, Italy and Spain on monthly data over the period 2006-2017. The interactions between repo markets, sovereign bonds and banks' CDS spreads are analyzed, explicitly accounting for the country-specific effects of the ECB's asset purchase programmes. Impulse response analysis signals marginally significant core-periphery heterogeneity, flight-to-quality effects and spillovers between liquidity conditions and credit risk. Simulated reductions in ECB programmes tend to result in higher government bond yields and bank CDS spreads, especially for Italy and Spain, as well as in falling repo trade volumes and rising repo rates across the Euro area. However, only a few responses to shocks achieve statistical significance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Transmission of Monetary Policy via Common Cycles in the Euro Area

Jan Prüser, Lukas Berend

Monetary policy and the joint distribution of income and wealth: The heterogeneous case of the euro area

Anna Stelzer

Large datasets for the Euro Area and its member countries and the dynamic effects of the common monetary policy

Matteo Barigozzi, Claudio Lissona, Lorenzo Tonni

No citations found for this paper.

Comments (0)