Summary

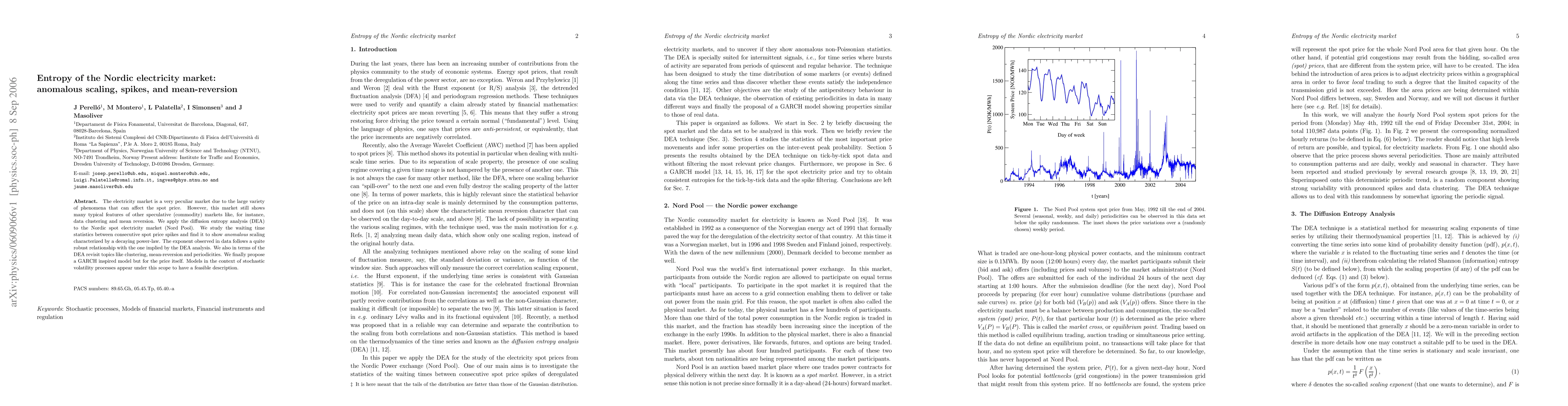

The electricity market is a very peculiar market due to the large variety of phenomena that can affect the spot price. However, this market still shows many typical features of other speculative (commodity) markets like, for instance, data clustering and mean reversion. We apply the diffusion entropy analysis (DEA) to the Nordic spot electricity market (Nord Pool). We study the waiting time statistics between consecutive spot price spikes and find it to show anomalous scaling characterized by a decaying power-law. The exponent observed in data follows a quite robust relationship with the one implied by the DEA analysis. We also in terms of the DEA revisit topics like clustering, mean-reversion and periodicities. We finally propose a GARCH inspired model but for the price itself. Models in the context of stochastic volatility processes appear under this scope to have a feasible description.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)