Summary

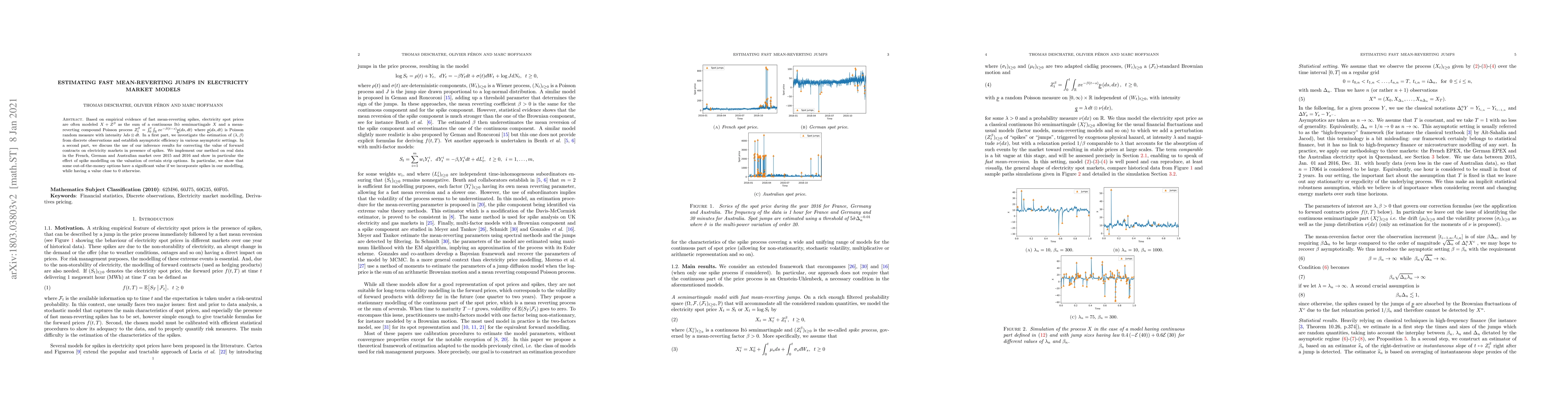

Based on empirical evidence of fast mean-reverting spikes, we model electricity price processes $X+Z^\beta$ as the sum of a continuous It\^o semimartingale $X$ and a a mean-reverting compound Poisson process $Z_t^\beta = \int_0^t \int_{\mathbb{R}} xe^{-\beta(t-s)}\underline{p}(ds,dt)$ where $\underline{p}(ds,dt)$ is Poisson random measure with intensity $\lambda ds\otimes dt$. In a first part, we investigate the estimation of $(\lambda,\beta)$ from discrete observations and establish asymptotic efficiency in various asymptotic settings. In a second part, we discuss the use of our inference results for correcting the value of forward contracts on electricity markets in presence of spikes. We implement our method on real data in the French, Greman and Australian market over 2015 and 2016 and show in particular the effect of spike modelling on the valuation of certain strip options. In particular, we show that some out-of-the-money options have a significant value if we incorporate spikes in our modelling, while having a value close to $0$ otherwise.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)