Summary

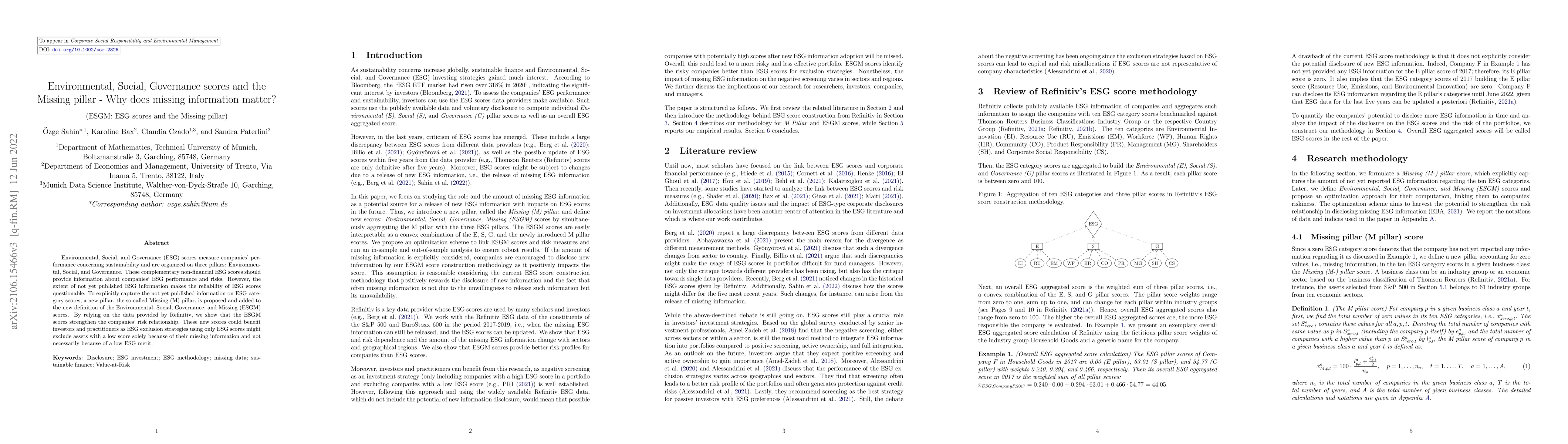

Environmental, Social, and Governance (ESG) scores measure companies' performance concerning sustainability and societal impact and are organized on three pillars: Environmental (E), Social (S), and Governance (G). These complementary non-financial ESG scores should provide information about the ESG performance and risks of different companies. However, the extent of not yet published ESG information makes the reliability of ESG scores questionable. To explicitly denote the not yet published information on ESG category scores, a new pillar, the so-called Missing (M) pillar, is formulated. Environmental, Social, Governance, and Missing (ESGM) scores are introduced to consider the potential release of new information in the future. Furthermore, an optimization scheme is proposed to compute ESGM scores, linking them to the companies' riskiness. By relying on the data provided by Refinitiv, we show that the ESGM scores strengthen the companies' risk relationship. These new scores could benefit investors and practitioners as ESG exclusion strategies using only ESG scores might exclude assets with a low score solely because of their missing information and not necessarily because of a low ESG merit.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Missing Scores in Evolving Multibiometric Systems

Anil Jain, Arun Ross, Melissa R Dale

Why Not? Explaining Missing Entailments with Evee (Technical Report)

Stefan Borgwardt, Patrick Koopmann, Christian Alrabbaa et al.

Classification of datasets with imputed missing values: does imputation quality matter?

Carola-Bibiane Schönlieb, Pietro Lio, Evis Sala et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)