Summary

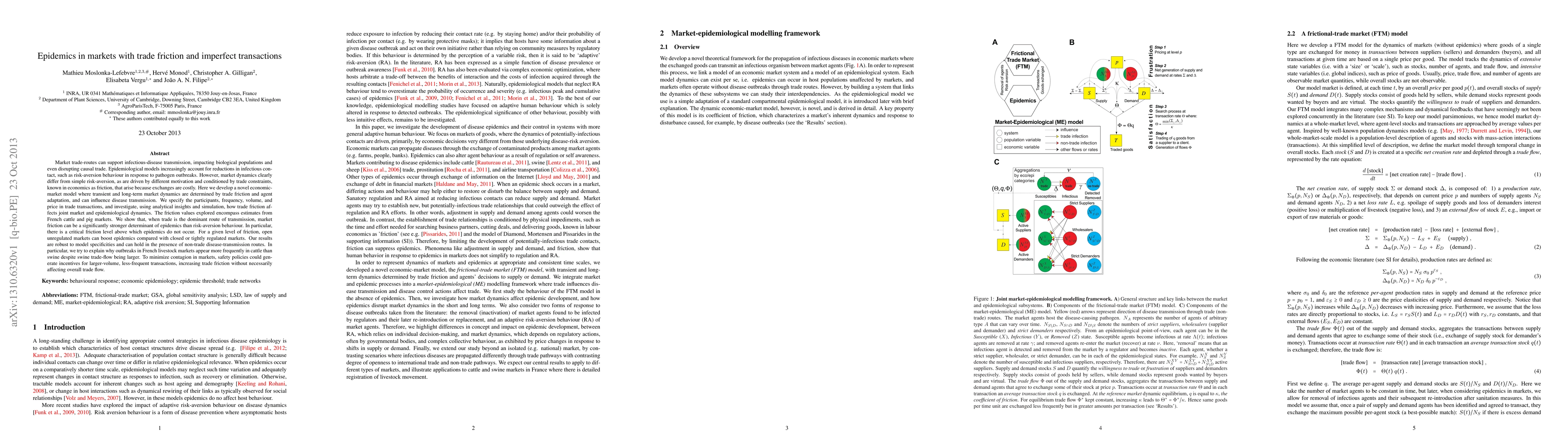

Market trade-routes can support infectious-disease transmission, impacting biological populations and even disrupting causal trade. Epidemiological models increasingly account for reductions in infectious contact, such as risk-aversion behaviour in response to pathogen outbreaks. However, market dynamics clearly differ from simple risk-aversion, as are driven by different motivation and conditioned by trade constraints, known in economics as friction, that arise because exchanges are costly. Here we develop a novel economic-market model where transient and long-term market dynamics are determined by trade friction and agent adaptation, and can influence disease transmission. We specify the participants, frequency, volume, and price in trade transactions, and investigate, using analytical insights and simulation, how trade friction affects joint market and epidemiological dynamics. The friction values explored encompass estimates from French cattle and pig markets. We show that, when trade is the dominant route of transmission, market friction can be a significantly stronger determinant of epidemics than risk-aversion behaviour. In particular, there is a critical friction level above which epidemics do not occur. For a given level of friction, open unregulated markets can boost epidemics compared with closed or tightly regulated markets. Our results are robust to model specificities and can hold in the presence of non-trade disease-transmission routes. In particular, we try to explain why outbreaks in French livestock markets appear more frequently in cattle than swine despite swine trade-flow being larger. To minimize contagion in markets, safety policies could generate incentives for larger-volume, less-frequent transactions, increasing trade friction without necessarily affecting overall trade flow.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKinetic modelling of economic markets with individual and collective transactions

Chuandong Lin, Lijie Cui

The increasing share of low-value transactions in international trade

Raúl Mínguez, Asier Minondo

| Title | Authors | Year | Actions |

|---|

Comments (0)