Authors

Summary

Two kinetic exchange models are proposed to explore the dynamics of closed economic markets characterized by random exchanges, saving propensities, and collective transactions. Model I simulates a system where individual transactions occur among agents with saving tendencies, along with collective transactions between groups. Model II restricts individual transactions to agents within the same group, but allows for collective transactions between groups. A three-step trading process--comprising intergroup transactions, intragroup redistribution, and individual exchanges--is developed to capture the dual-layered market dynamics. The saving propensity is incorporated using the Chakraborti-Chakrabarti model, applied to both individual and collective transactions. Results reveal that collective transactions increase wealth inequality by concentrating wealth within groups, as indicated by higher Gini coefficients and Kolkata indices. In contrast, individual transactions across groups mitigate inequality through more uniform wealth redistribution. The interplay between saving propensities and collective transactions governs deviation degree and entropy, which display inverse trends. Higher saving propensities lead to deviations from the Boltzmann-Gibbs equilibrium, whereas specific thresholds result in collective transaction dominance, producing notable peaks or troughs in these metrics. These findings underscore the critical influence of dual-layered market interactions on wealth distribution and economic dynamics.

AI Key Findings

Generated Jun 11, 2025

Methodology

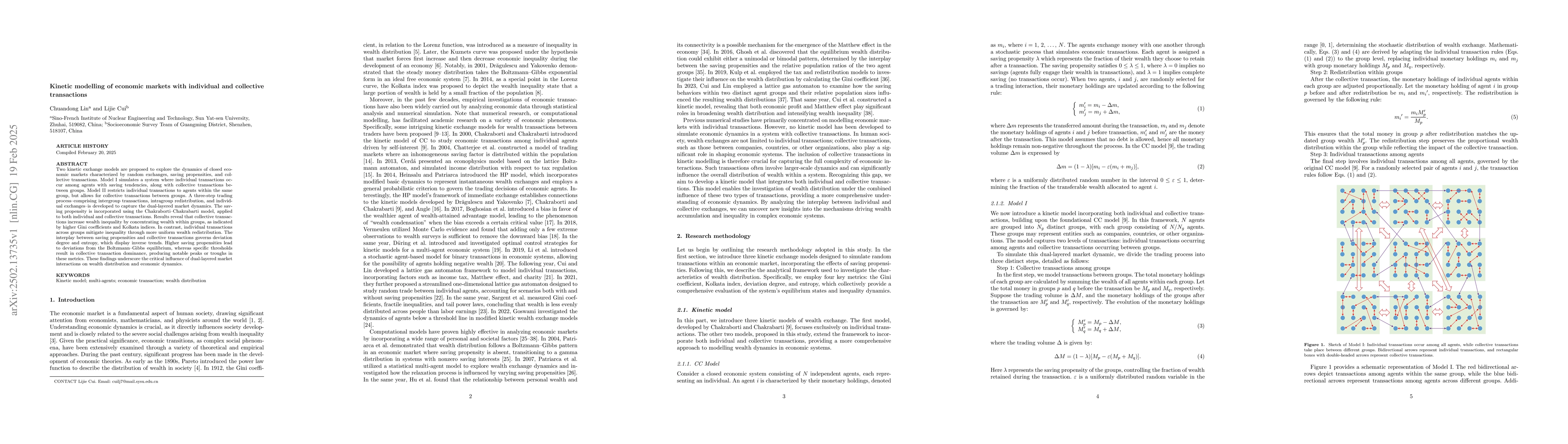

Two kinetic exchange models (Model I and Model II) were proposed to simulate closed economic markets with random exchanges, saving propensities, and collective transactions, using a three-step trading process to capture dual-layered market dynamics.

Key Results

- Collective transactions increase wealth inequality by concentrating wealth within groups, indicated by higher Gini coefficients and Kolkata indices.

- Individual transactions across groups mitigate inequality through more uniform wealth redistribution.

- Higher saving propensities lead to deviations from the Boltzmann-Gibbs equilibrium, with specific thresholds resulting in collective transaction dominance, producing notable peaks or troughs in deviation degree and entropy metrics.

- An intermediary number of trading groups intensifies wealth inequality, while very small or excessively large numbers foster greater wealth equality.

- The critical threshold for the number of groups is identified as Nc = √N, where N represents the total number of agents.

Significance

This research enhances understanding of how individual and collective transaction mechanisms shape wealth distribution and market dynamics, offering a flexible framework for exploring real-world market phenomena.

Technical Contribution

The paper introduces two kinetic models (Model I and Model II) to simulate economic markets with individual and collective transactions, incorporating saving propensity using the Chakraborti-Chakrabarti model.

Novelty

The research provides new insights into the interaction between individual and collective transaction mechanisms in shaping wealth distribution, offering a flexible framework for exploring real-world market phenomena.

Limitations

- The study focuses on simplified kinetic models and does not incorporate additional factors like taxation policies, group heterogeneity, or external shocks.

- The findings are based on simulations and may not fully capture the complexities of real-world economic systems.

Future Work

- Expand the models to include taxation policies, group heterogeneity, and external shocks for a more realistic representation of economic systems.

- Investigate the impact of varying market structures and agent behaviors on wealth distribution and economic dynamics.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKinetic modeling of economic markets with heterogeneous saving propensities

Chuandong Lin, Lijie Cui

| Title | Authors | Year | Actions |

|---|

Comments (0)