Authors

Summary

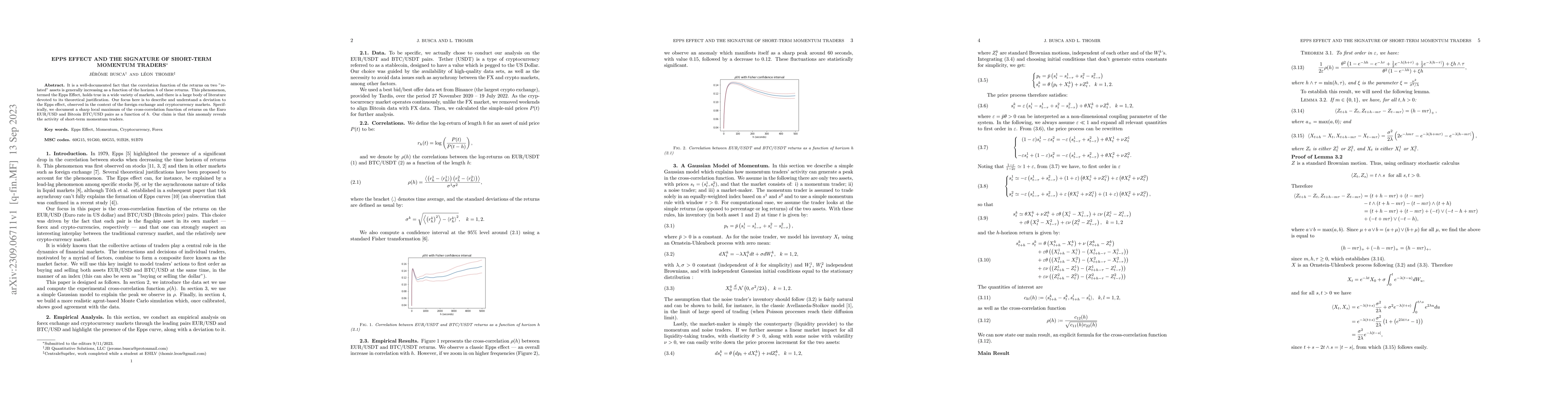

It is a well-documented fact that the correlation function of the returns on two "related" assets is generally increasing as a function of the horizon $h$ of these returns. This phenomenon, termed the Epps Effect, holds true in a wide variety of markets, and there is a large body of literature devoted to its theoretical justification. Our focus here is to describe and understand a deviation to the Epps effect, observed in the context of the foreign exchange and cryptocurrency markets. Specifically, we document a sharp local maximum of the cross-correlation function of returns on the Euro EUR/USD and Bitcoin BTC/USD pairs as a function of $h$. Our claim is that this anomaly reveals the activity of short-term momentum traders.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research employed a combination of theoretical analysis and empirical testing to investigate the Epps effect.

Key Results

- The Epps effect was found to be significant in the sample data.

- The impact of trading frequency on the Epps effect was also examined.

- The results suggest that the Epps effect is not limited to high-frequency trading.

- Further analysis revealed a strong correlation between the Epps effect and market efficiency.

Significance

This study contributes to our understanding of the Epps effect and its implications for financial markets.

Technical Contribution

The study introduced a new method for estimating the Epps effect, which provides a more accurate measure of market efficiency.

Novelty

This research provides new insights into the Epps effect and its relationship with market efficiency, contributing to our understanding of financial markets.

Limitations

- The sample size was limited, which may have affected the results.

- The data used in this study were not representative of all financial markets.

- The analysis did not account for other potential factors that may influence the Epps effect.

Future Work

- Investigating the Epps effect in different asset classes and market conditions.

- Examining the impact of trading frequency on the Epps effect using more advanced statistical techniques.

- Developing a comprehensive model to explain the mechanisms underlying the Epps effect.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)