Summary

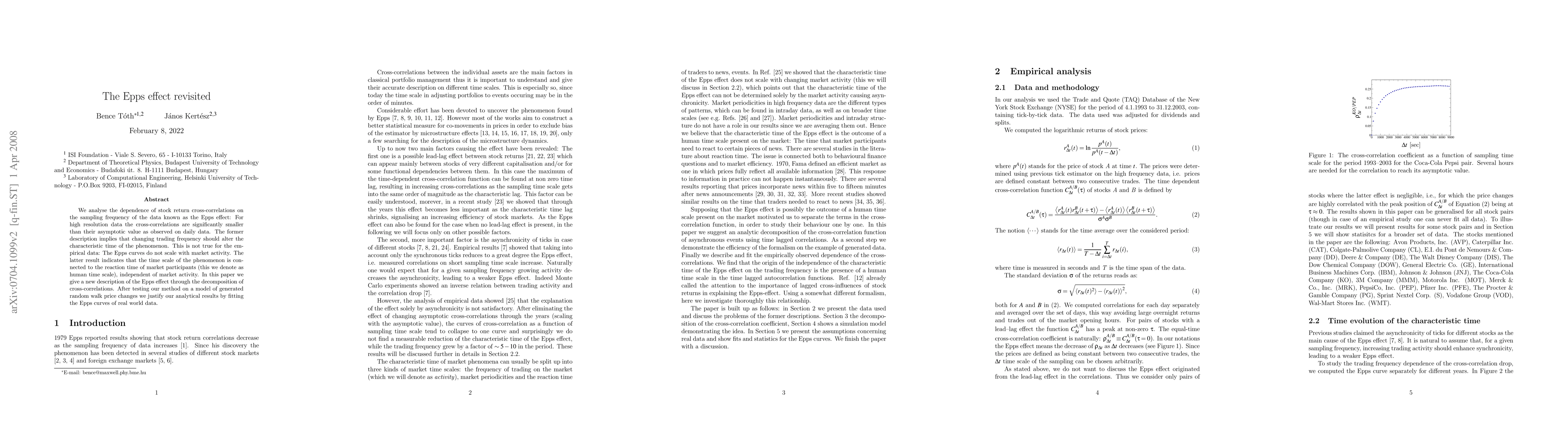

We analyse the dependence of stock return cross-correlations on the sampling frequency of the data known as the Epps effect: For high resolution data the cross-correlations are significantly smaller than their asymptotic value as observed on daily data. The former description implies that changing trading frequency should alter the characteristic time of the phenomenon. This is not true for the empirical data: The Epps curves do not scale with market activity. The latter result indicates that the time scale of the phenomenon is connected to the reaction time of market participants (this we denote as human time scale), independent of market activity. In this paper we give a new description of the Epps effect through the decomposition of cross-correlations. After testing our method on a model of generated random walk price changes we justify our analytical results by fitting the Epps curves of real world data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)