Summary

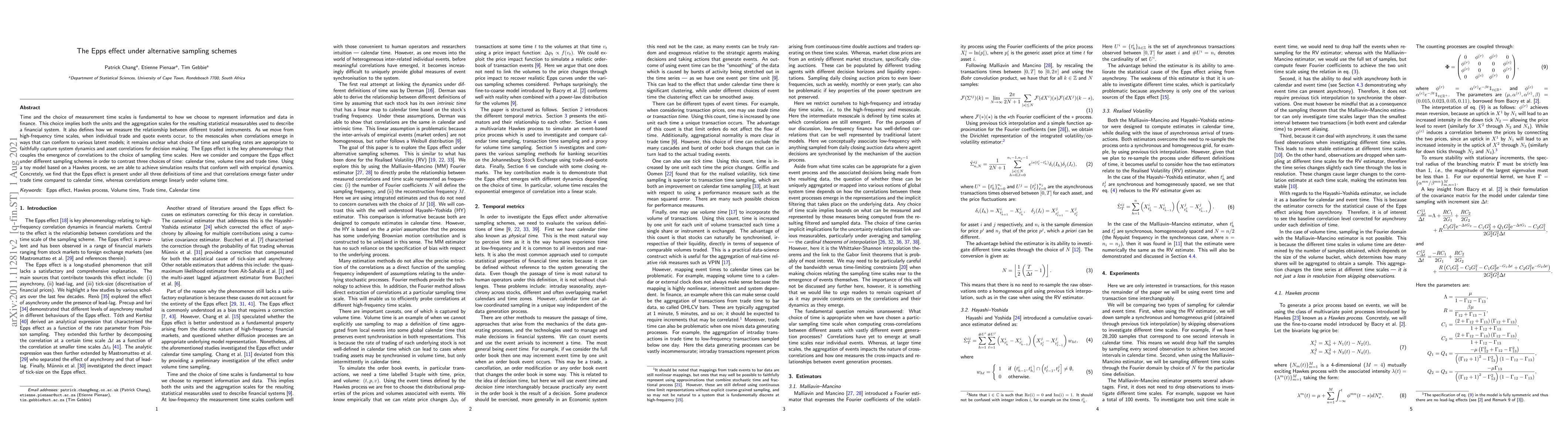

Time and the choice of measurement time scales is fundamental to how we choose to represent information and data in finance. This choice implies both the units and the aggregation scales for the resulting statistical measurables used to describe a financial system. It also defines how we measure the relationship between different traded instruments. As we move from high-frequency time scales, when individual trade and quote events occur, to the mesoscales when correlations emerge in ways that can conform to various latent models; it remains unclear what choice of time and sampling rates are appropriate to faithfully capture system dynamics and asset correlations for decision making. The Epps effect is the key phenomenology that couples the emergence of correlations to the choice of sampling time scales. Here we consider and compare the Epps effect under different sampling schemes in order to contrast three choices of time: calendar time, volume time and trade time. Using a toy model based on a Hawkes process, we are able to achieve simulation results that conform well with empirical dynamics. Concretely, we find that the Epps effect is present under all three definitions of time and that correlations emerge faster under trade time compared to calendar time, whereas correlations emerge linearly under volume time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)