Summary

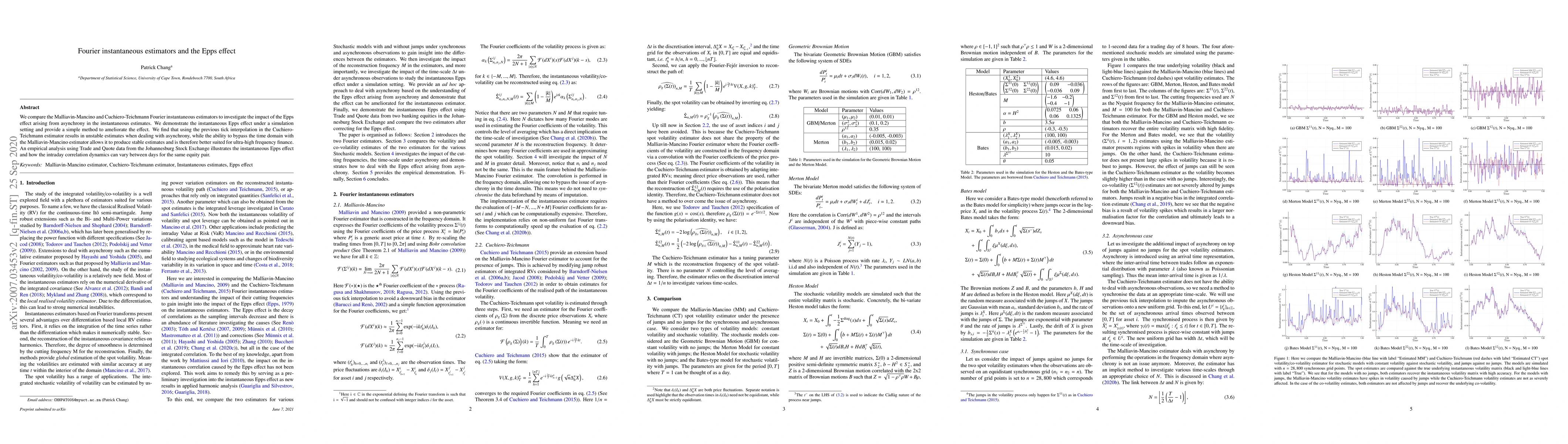

We compare the Malliavin-Mancino and Cuchiero-Teichmann Fourier instantaneous estimators to investigate the impact of the Epps effect arising from asynchrony in the instantaneous estimates. We demonstrate the instantaneous Epps effect under a simulation setting and provide a simple method to ameliorate the effect. We find that using the previous tick interpolation in the Cuchiero-Teichmann estimator results in unstable estimates when dealing with asynchrony, while the ability to bypass the time domain with the Malliavin-Mancino estimator allows it to produce stable estimates and is therefore better suited for ultra-high frequency finance. An empirical analysis using Trade and Quote data from the Johannesburg Stock Exchange illustrates the instantaneous Epps effect and how the intraday correlation dynamics can vary between days for the same equity pair.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)