Authors

Summary

This paper solves the consumption-investment problem under Epstein-Zin preferences on a random horizon. In an incomplete market, we take the random horizon to be a stopping time adapted to the market filtration, generated by all observable, but not necessarily tradable, state processes. Contrary to prior studies, we do not impose any fixed upper bound for the random horizon, allowing for truly unbounded ones. Focusing on the empirically relevant case where the risk aversion and the elasticity of intertemporal substitution are both larger than one, we characterize the optimal consumption and investment strategies using backward stochastic differential equations with superlinear growth on unbounded random horizons. This characterization, compared with the classical fixed-horizon result, involves an additional stochastic process that serves to capture the randomness of the horizon. As demonstrated in two concrete examples, changing from a fixed horizon to a random one drastically alters the optimal strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

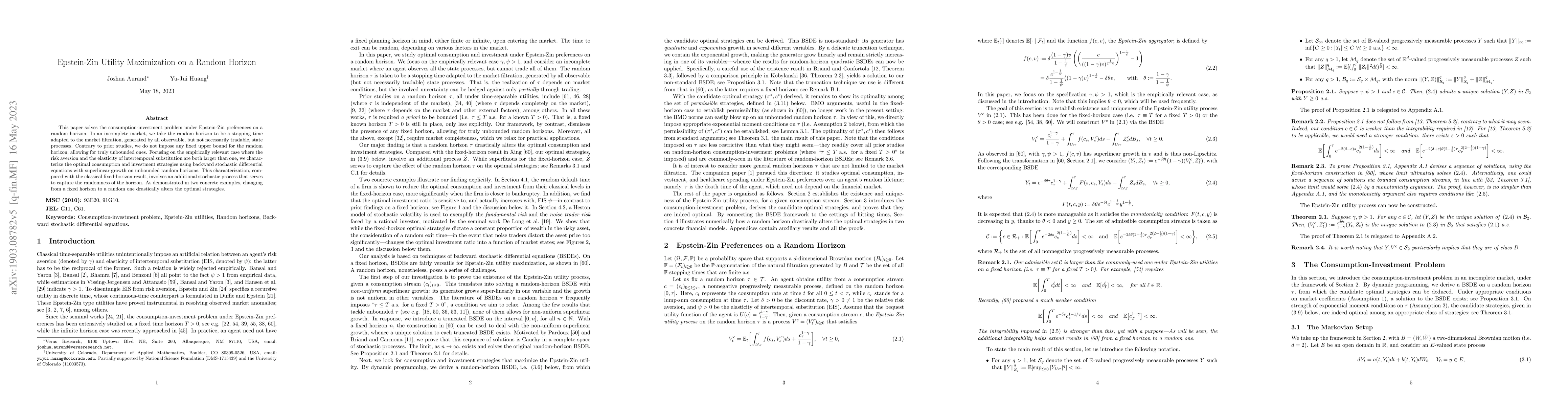

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)