Summary

In this article we consider the optimal investment-consumption problem for an agent with preferences governed by Epstein-Zin stochastic differential utility who invests in a constant-parameter Black-Scholes-Merton market. The paper has three main goals: first, to provide a detailed introduction to infinite-horizon Epstein-Zin stochastic differential utility, including a discussion of which parameter combinations lead to a well-formulated problem; second, to prove existence and uniqueness of infinite horizon Epstein-Zin stochastic differential utility under a restriction on the parameters governing the agent's risk aversion and temporal variance aversion; and third, to provide a verification argument for the candidate optimal solution to the investment-consumption problem among all admissible consumption streams. To achieve these goals, we introduce a slightly different formulation of Epstein-Zin stochastic differential utility to that which is traditionally used in the literature. This formulation highlights the necessity and appropriateness of certain restrictions on the parameters governing the stochastic differential utility function.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

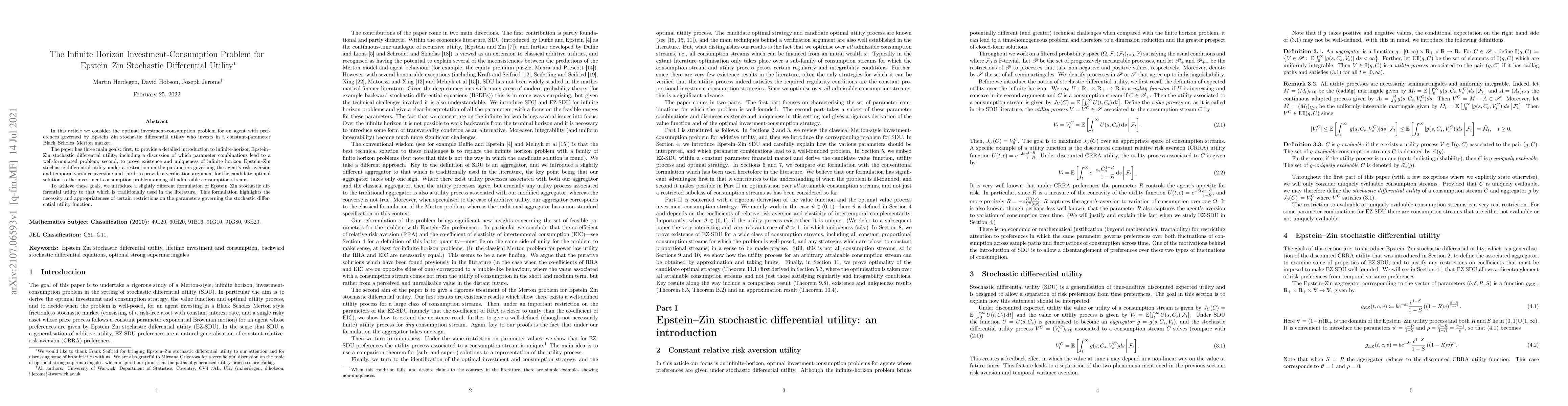

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConsumption-investment optimization with Epstein-Zin utility in unbounded non-Markovian markets

Harry Zheng, Dejian Tian, Zixin Feng

Epstein-Zin Utility Maximization on a Random Horizon

Yu-Jui Huang, Joshua Aurand

| Title | Authors | Year | Actions |

|---|

Comments (0)