Summary

This paper studies an optimal dividend problem for a company that aims to maximize the mean-variance (MV) objective of the accumulated discounted dividend payments up to its ruin time. The MV objective involves an integral form over a random horizon that depends endogenously on the company's dividend strategy, and these features lead to a novel time-inconsistent control problem. To address the time inconsistency, we seek a time-consistent equilibrium dividend rate strategy. We first develop and prove a new verification lemma that characterizes the value function and equilibrium strategy by an extended Hamilton-Jacobi-Bellman system. Next, we apply the verification lemma to obtain the equilibrium strategy and show that it is a barrier strategy for small levels of risk aversion.

AI Key Findings

Generated Sep 03, 2025

Methodology

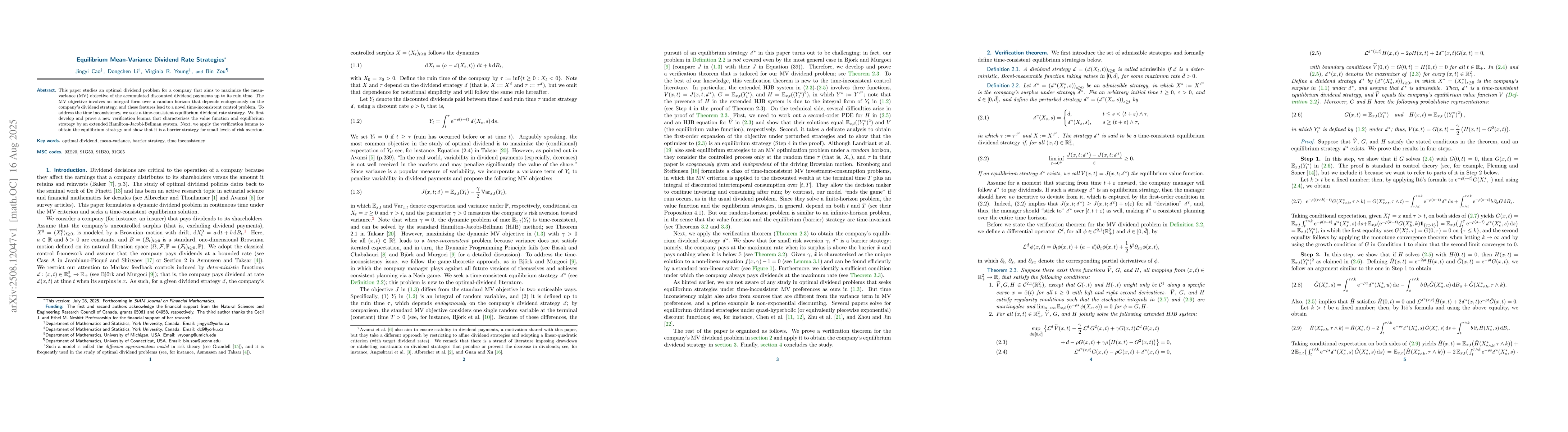

The paper formulates an optimal dividend rate problem under the mean-variance (MV) criterion for a company with a Brownian motion surplus, addressing time-inconsistency through a novel verification lemma and equilibrium strategy.

Key Results

- A verification theorem tailored to the MV dividend problem is developed and applied to show that for small γ (risk aversion towards variance), a barrier dividend strategy is the equilibrium strategy.

- Two successful applications of the verification lemma yield close-form solutions for small γ, requiring minimal risk aversion.

- The equilibrium strategy is found to be a time-inconsistent barrier strategy for small γ, with open questions regarding its derivation for all γ > 0.

Significance

This research contributes to the understanding of optimal dividend policies in insurance and finance, providing insights into how risk aversion affects dividend strategies and offering a framework for future exploration of time-inconsistent problems.

Technical Contribution

The paper introduces a new verification theorem and applies it to characterize equilibrium dividend strategies under the MV criterion, addressing time-inconsistency in a novel manner.

Novelty

The research presents a unique approach to the time-inconsistent optimal dividend problem by focusing on the mean-variance trade-off and deriving explicit solutions for small γ, distinguishing it from previous work that primarily dealt with constant γ or specific barrier conditions.

Limitations

- The study focuses on small γ, leaving open the question of equilibrium strategies for larger γ values.

- The model assumes a bounded dividend rate, which may not reflect real-world scenarios with lump-sum payments.

Future Work

- Investigate equilibrium strategies for all γ > 0 to provide a comprehensive understanding of dividend policies.

- Explore singular control setups and allow for unbounded dividend rates to create a more realistic model.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEquilibrium Strategies for the N-agent Mean-Variance Investment Problem over a Random Horizon

Ying Yang, Jie Xiong, Xiaoqing Liang

Comments (0)