Authors

Summary

We study equilibrium feedback strategies for a family of dynamic mean-variance problems with competition among a large group of agents. We assume that the time horizon is random and each agent's risk aversion depends dynamically on the current wealth. We consider both the finite population game and the corresponding mean-field one. Each agent can invest in a risk-free asset and a specific individual stock, which is correlated with other stocks by a common noise. By applying stochastic control theory, we derive the extended Hamilton-Jacobi-Bellman (HJB) system of equations for both $n$-agent and mean-field games. Under an exponentially distributed random horizon, we explicitly obtain the equilibrium feedback strategies and the value functions in both cases. Our results show that the agent's equilibrium feedback strategy depends not only on his/her current wealth but also on the wealth of other competitors. Moreover, when the risk aversion is state-independent and the risk-free interest rate is set to zero, the equilibrium strategies degenerate to constants, which is identical to the unique equilibrium obtained in \citet{lacker2019mean} with exponential risk preferences; when the competition parameter goes to zero and the risk aversion equals some specific value, the equilibrium strategies coincide with the ones derived in \citet{landriault2018equilibrium}.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

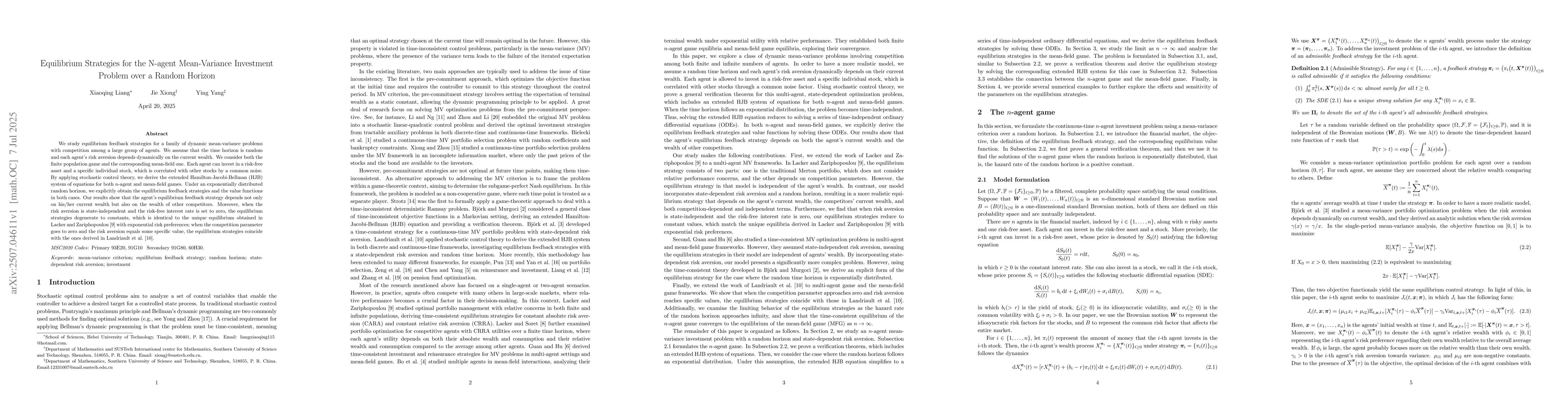

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust equilibrium strategy for mean-variance-skewness portfolio selection problem

Zhihao Hu, Nan-jing Huang, Jian-hao Kang et al.

No citations found for this paper.

Comments (0)