Summary

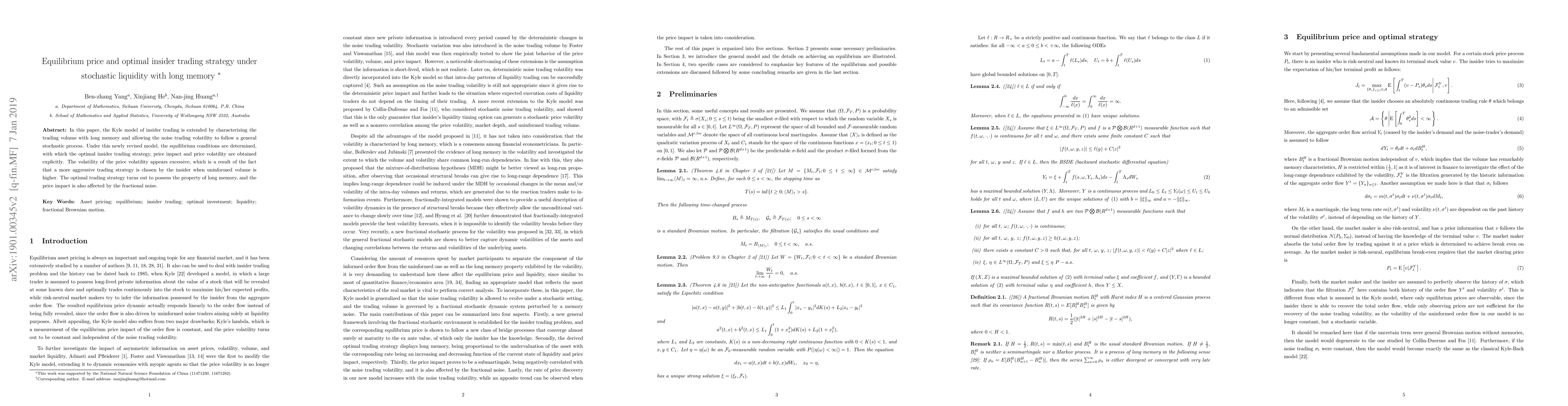

In this paper, the Kyle model of insider trading is extended by characterizing the trading volume with long memory and allowing the noise trading volatility to follow a general stochastic process. Under this newly revised model, the equilibrium conditions are determined, with which the optimal insider trading strategy, price impact and price volatility are obtained explicitly. The volatility of the price volatility appears excessive, which is a result of the fact that a more aggressive trading strategy is chosen by the insider when uninformed volume is higher. The optimal trading strategy turns out to possess the property of long memory, and the price impact is also affected by the fractional noise.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Trading with Signals and Stochastic Price Impact

Sebastian Jaimungal, Jean-Pierre Fouque, Yuri F. Saporito

| Title | Authors | Year | Actions |

|---|

Comments (0)