Summary

We consider a one-period Kyle (1985) framework where the insider can be subject to a penalty if she trades. We establish existence and uniqueness of equilibrium for virtually any penalty function when noise is uniform. In equilibrium, the demand of the insider and the price functions are in general non-linear and remain analytically tractable because the expected price function is linear. We use this result to investigate the trade off between price efficiency and 'fairness': we consider a regulator that wants to minimise post-trade standard deviation for a given level of uninformed traders' losses. The minimisation is over the function space of penalties; for each possible penalty, our existence and uniqueness theorem allows to define unambiguously the post-trade standard deviation and the uninformed traders' losses that prevail in equilibrium.Optimal penalties are characterized in closed-form. They must increase quickly with the magnitude of the insider's order for small orders and become flat for large orders: in cases where the fundamental realizes at very high or very low values, the insider finds it optimal to trade despite the high penalty. Although such trades-if they occur-are costly for liquidity traders, they signal extreme events and therefore incorporate a lot of information into prices. We generalize this result in two directions by imposing a budget constraint on the regulator and considering the cases of either non-pecuniary or pecuniary penalties. In the first case, we establish that optimal penalties are a subset of the previously optimal penalties: the patterns of equilibrium trade volumes and prices is unchanged. In the second case, we also fully characterize the constrained efficient points and penalties and show that new patterns emerge in the demand schedules of the insider trader and the associated price functions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

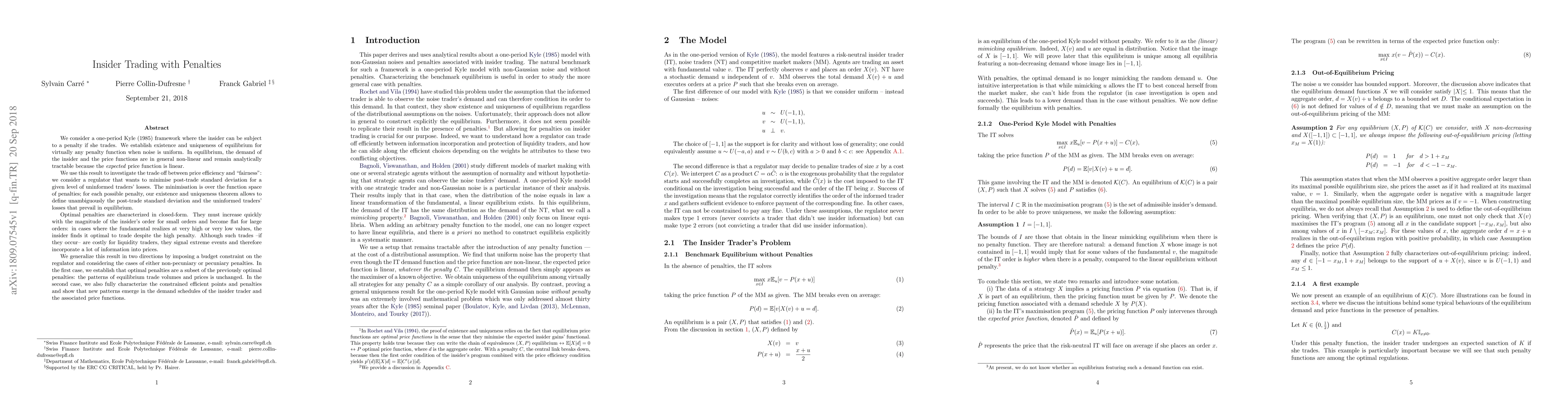

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)